Table of Contents

Building wealth isn't just about making more money—it requires completely different strategies at each level of net worth.

Key Takeaways

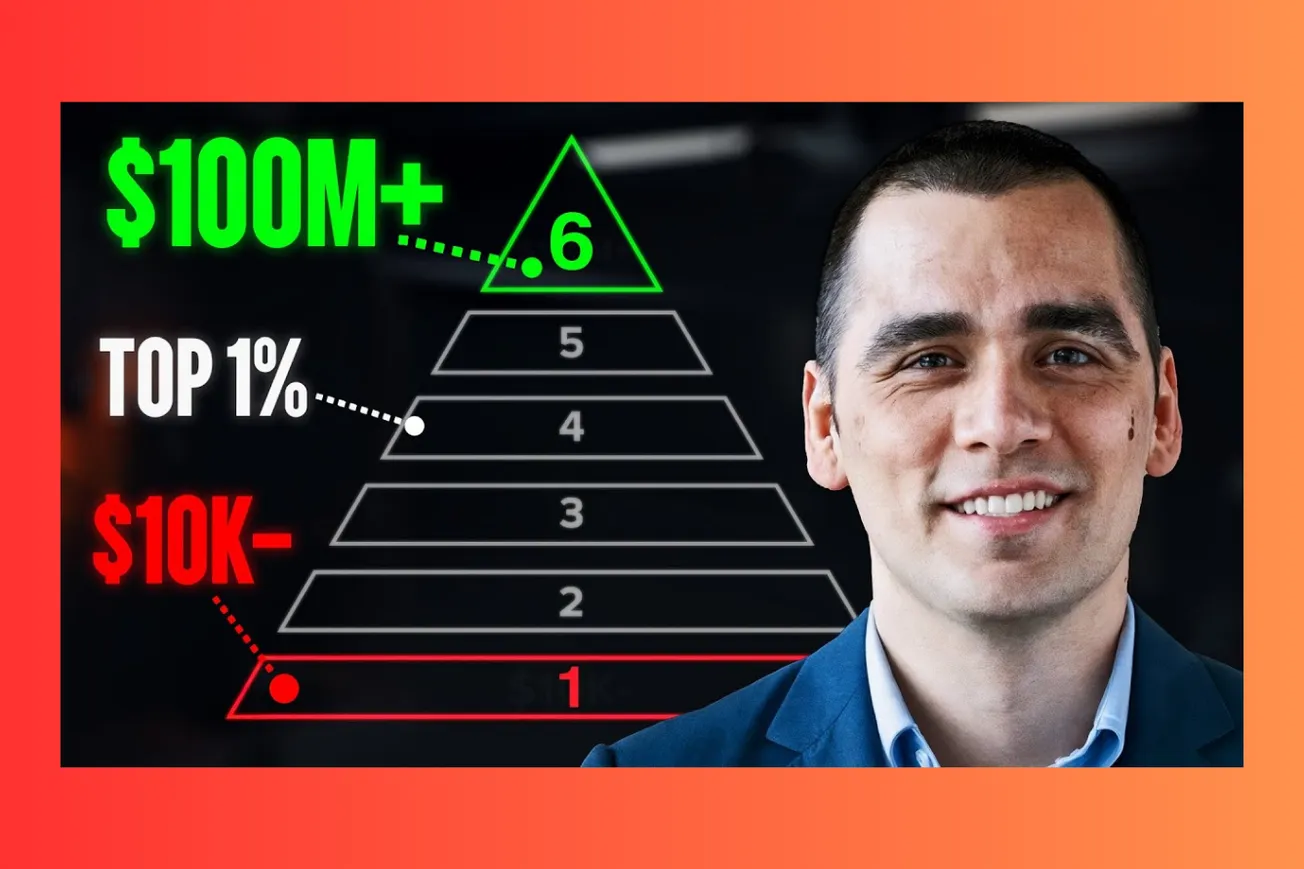

- The wealth ladder divides financial progress into six distinct levels based on net worth, from under $10K to over $100 million

- Each level requires fundamentally different strategies, with the jump from $1-10 million being the most challenging transition

- The 0.01% rule helps determine daily spending freedom: divide your net worth by 10,000 for trivial purchase amounts

- Level 4 to 5 ($1M to $10M) requires entrepreneurship rather than traditional saving and investing strategies

- Most Americans (40%) fall into Level 3 ($100K-$1M), representing the middle class wealth bracket

- Time alone cannot bridge higher wealth levels—strategic changes in approach become essential after reaching millionaire status

- Wealth-based spending decisions provide more stability than income-based financial planning due to income volatility

- The concentration risk from crypto gains can create rapid wealth level jumps but requires careful diversification strategies

- Beyond Level 4, additional wealth accumulation often yields diminishing returns on life satisfaction and freedom

Understanding the Wealth Ladder Framework

The wealth ladder represents a fundamental shift in how we think about personal finance strategy. Rather than applying one-size-fits-all advice, this framework recognizes that your financial approach must evolve as your net worth grows. Each level represents roughly a 10x increase in wealth, creating natural breaking points where different strategies become necessary.

- The logarithmic scaling reflects how money impacts happiness and lifestyle freedom, with each 10x increase in wealth producing similar psychological benefits rather than linear improvements

- Level placement depends on total net worth calculation: all assets minus all liabilities, including cash, investments, real estate, vehicles, minus debts like mortgages, credit cards, and student loans

- Approximately 40% of US households occupy Level 3 ($100K-$1M), making this the true middle class wealth bracket in America today

- The framework serves as both diagnostic tool and strategic roadmap, helping individuals identify their current position and understand what changes are needed for advancement

- Unlike income-based financial planning, wealth-based strategies provide more stability since wealth typically fluctuates less dramatically than employment income

- Each level amplifies different aspects of financial life: Level 1 amplifies bad luck, Level 2 begins offering spending freedom, Level 3 enables restaurant flexibility, Level 4 allows vacation freedom

The 0.01% Spending Rule and Lifestyle Design

Revolutionary approach to lifestyle inflation comes through the 0.01% rule, which mathematically determines appropriate spending increases as wealth grows. This formula prevents both excessive frugality and dangerous overspending by tying discretionary purchases to actual wealth accumulation rather than income fluctuations.

- Daily trivial spending amount equals net worth divided by 10,000, meaning someone with $500K net worth can comfortably spend $50 daily on marginal purchases without wealth impact

- The rule assumes conservative 0.01% daily wealth generation (roughly 3.7% annually), providing mathematical justification for spending patterns that maintain wealth stability over time

- Grocery price sensitivity disappears around Level 2 ($10K+ net worth), restaurant prices become irrelevant at Level 3 ($100K+), and vacation costs lose significance entering Level 4 ($1M+)

- Wealth-based spending provides superior framework compared to income-based budgeting because income can disappear overnight while wealth typically changes more gradually

- Professional athletes exemplify income-based spending dangers: earning $5M annually but spending $2M creates vulnerability if career-ending injury occurs in year two

- Liquid net worth considerations become crucial for spending decisions, as home equity and retirement accounts may not support immediate lifestyle choices despite contributing to overall wealth calculations

Strategic Approaches for Early Wealth Levels

The foundation levels of the wealth ladder require distinct tactical approaches that prioritize different elements of financial health. Success at these stages creates momentum for higher level achievements, while failure can trap individuals in cycles of financial stress and missed opportunities.

- Level 1 strategy centers on building safety nets and redundancy systems, recognizing that bad luck gets amplified dramatically when resources are scarce

- Emergency fund establishment takes priority over investment returns at Level 1, as a blown tire could trigger job loss, debt accumulation, and long-term financial damage for someone without reserves

- Data reveals 50% of financial distress events affect just 10% of the population, suggesting some individuals get trapped in recurring cycles of financial setbacks that become increasingly difficult to escape

- Level 2 divides into two distinct populations: young professionals with good earning potential who simply need time, and older workers with income limitations requiring skill development and education investments

- Education and skill-building become primary Level 2 investments, whether through traditional university programs, trade schools, coding bootcamps, or other professional development that increases earning capacity over time

- The "just keep buying" strategy dominates Level 3 success, involving systematic purchase of diversified income-producing assets combined with patient wealth accumulation over extended periods

Why Level 3 to 4 Transition Often Fails

Statistical analysis reveals that many households become trapped in Level 3, never successfully transitioning to millionaire status despite years of effort. Understanding these failure patterns helps identify and avoid common pitfalls that derail wealth accumulation momentum.

- Comparative studies of households starting in Level 3 show two key differences between those reaching Level 4 and those remaining stuck: higher starting incomes and dramatically lower spending relative to income

- Housing costs represent the primary wealth accumulation killer for Level 3 households, with over 60% of their net worth typically concentrated in home equity rather than liquid investments

- Lifestyle inflation particularly impacts real estate decisions, as households justify expensive housing based on current income rather than considering long-term wealth building implications

- Level 3 households often spend nearly as much as those successfully transitioning to Level 4, despite earning significantly less, creating insufficient savings rates for meaningful wealth accumulation

- Geographic factors compound the challenge, with high-cost areas making it nearly impossible to maintain reasonable housing cost ratios while building substantial investment portfolios

- Time becomes both ally and enemy in Level 3: sufficient time allows compound growth to work, but extended periods in expensive housing situations can permanently derail millionaire aspirations

The Mathematical Reality of Higher Wealth Levels

Reaching Level 5 ($10M+) requires completely abandoning traditional wealth-building strategies that worked for earlier levels. Mathematical analysis reveals why time and savings alone cannot bridge this gap, necessitating fundamental strategic shifts toward entrepreneurship and business ownership.

- A millionaire earning 5% annually while saving $100,000 per year requires 28 years to reach $10 million, demonstrating the inadequacy of traditional employment-based wealth building at higher levels

- Entrepreneurship becomes the primary pathway beyond Level 4, with successful business sales, startup exits, or significant equity positions driving most transitions to Level 5 and above

- Serial entrepreneurship patterns emerge among ultra-wealthy individuals, with most requiring multiple business ventures before achieving major financial exits rather than succeeding on first attempts

- Mark Cuban, Elon Musk, and other ultra-wealthy individuals typically built and sold multiple companies before their headline-making transactions that created generational wealth

- The "coast FIRE" concept becomes relevant for many Level 4 individuals who realize additional grinding may not meaningfully improve their life satisfaction or freedom

- Level 4 represents a "no man's land" where traditional savings impact becomes negligible—$100K annual savings represents 10% of wealth at $1M but only 2% at $5M, making the effort feel increasingly pointless

Crypto Wealth Acceleration and Its Challenges

The cryptocurrency ecosystem has created unprecedented opportunities for rapid wealth level advancement, but also introduced unique challenges around concentration risk, timing decisions, and maintaining perspective on traditional wealth-building principles.

- Crypto's extreme volatility provides accelerated learning opportunities, with market lessons occurring 3-5x faster than traditional investing cycles, allowing investors to experience multiple market cycles in compressed timeframes

- Concentration risk becomes particularly dangerous with crypto wealth gains, as individuals may jump multiple wealth levels quickly without developing the diversification habits necessary for wealth preservation

- Real-world example demonstrates the challenge: investor purchased Solana NFTs for $350, portfolio peaked at $1.2 million, but ultimately extracted only $90K due to poor timing and concentration decisions

- The behavioral paradox emerges where the risk-taking mentality required for massive crypto gains directly conflicts with the risk management approaches necessary for wealth preservation

- Get-rich-quick mentalities prevalent in crypto communities can derail systematic wealth building, with endless pursuit of the next 100x return preventing focus on sustainable growth strategies

- Rebalancing discipline becomes crucial for crypto investors, as maintaining predetermined allocation percentages requires selling appreciated positions and buying underperforming assets contrary to emotional impulses

Beyond Financial Wealth: Purpose and Trade-offs

The highest levels of the wealth ladder introduce complexities that extend far beyond financial calculations, touching on relationships, purpose, and the fundamental question of whether extreme wealth accumulation serves meaningful life goals.

- Estate planning, tax optimization, and wealth protection strategies become necessary complications at Level 5, creating administrative overhead that didn't exist at lower wealth levels

- Interpersonal relationships face new challenges as extreme wealth creates uncertainty about others' motivations, particularly in dating scenarios where financial attraction may overshadow genuine connection

- Target risks emerge with publicly known wealth, as simple accidents or interactions may lead to lawsuits or exploitation attempts that wouldn't occur with middle-class individuals

- The irony of wealth accumulation becomes apparent: men often pursue riches to improve dating prospects, but extreme wealth actually complicates finding genuine relationships

- Purpose and meaning become critical considerations for those achieving financial independence, as pure consumption rarely provides long-term satisfaction without productive activities or clear goals

- Retirement planning must address "retiring to" something meaningful rather than simply "retiring from" work, as many financially independent individuals struggle with existential questions about their daily purpose and contribution

Wealth building represents a journey with multiple valid endpoints depending on individual values and life goals. The mathematical realities of each level help inform strategic decisions, but the ultimate question remains whether additional wealth accumulation serves broader life purposes beyond financial scorekeeping.