Table of Contents

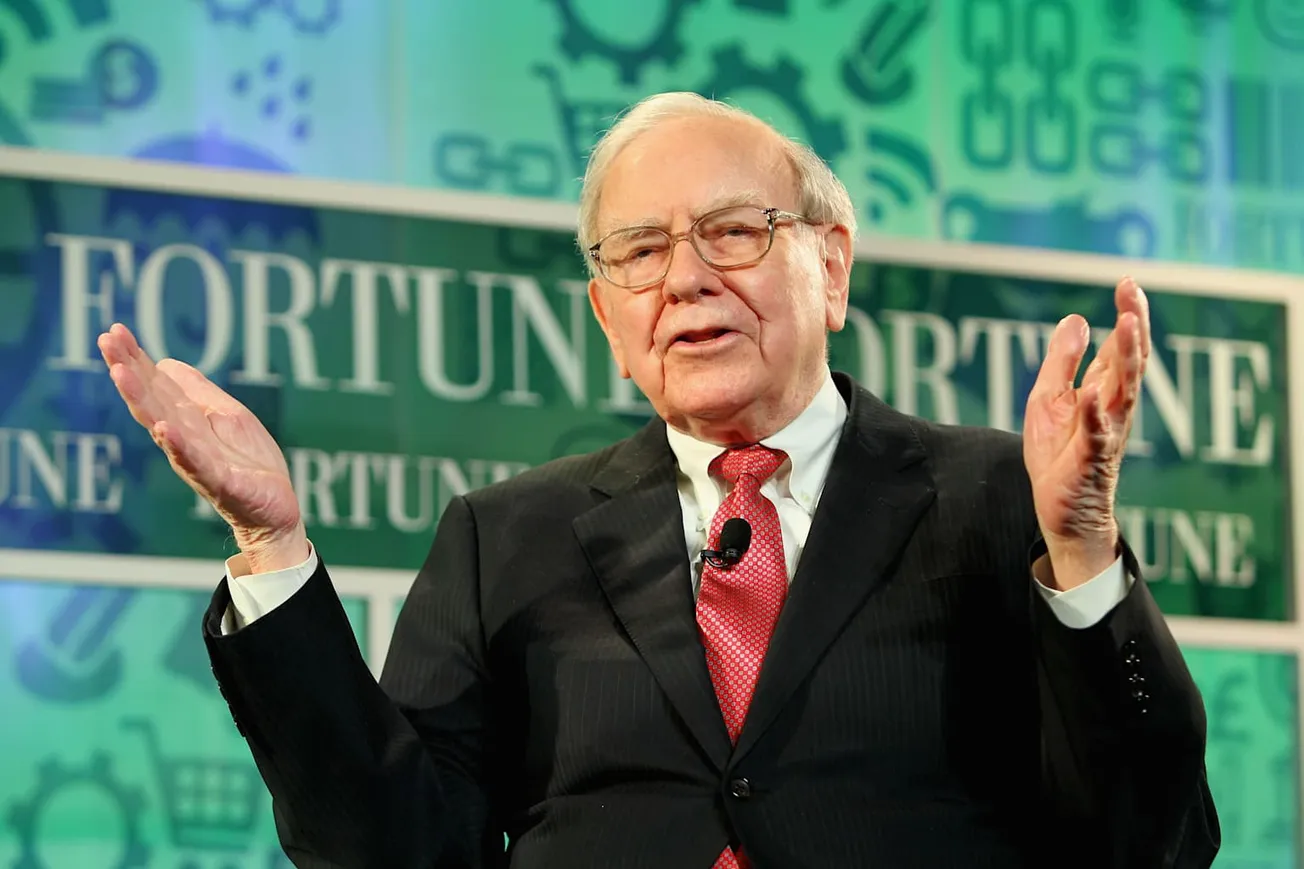

Warren Buffett, the 94-year-old legendary investor, has announced plans to step down as CEO of Berkshire Hathaway at the end of 2025, recommending Greg Abel as his successor.

Key Takeaways

- Warren Buffett will step down as Berkshire Hathaway CEO at the end of 2025 after leading the company for over five decades.

- Greg Abel, currently vice chairman overseeing non-insurance businesses, has been named as Buffett's successor.

- The announcement came during Berkshire's annual shareholder meeting in Omaha, surprising attendees and Abel himself.

- Buffett plans to remain as chairman of the board until his death, with his son Howard set to take over that role afterward.

- The transition comes as Berkshire Hathaway reaches record highs with a market value of approximately $1 trillion.

- Despite stepping down as CEO, Buffett has "zero" intention of selling his Berkshire stock.

- The 94-year-old investor leaves behind a legacy of transforming a struggling textile mill into one of the world's most valuable conglomerates.

The Announcement That Shook Wall Street

In a move that marks the end of an era in American business, Warren Buffett announced his plans to retire as CEO of Berkshire Hathaway after the company's annual meeting in Omaha, Nebraska. "I think the time has arrived where Greg should become the Chief Executive officer of the company at year end," Buffett told the packed arena of shareholders. The statement came as a surprise to many, including Abel himself, who was seated beside Buffett during the announcement.

The decision ends months of speculation about when the 94-year-old would finally step aside from daily operations of the $1 trillion conglomerate he built from a struggling textile company into one of the world's most valuable businesses. While Buffett had previously identified Abel as his successor in 2021, he had never before provided a timeline for the transition.

The announcement received a standing ovation from the thousands of shareholders present, many of whom have followed Buffett's career and wisdom for decades. Despite the change in leadership, Buffett assured investors he would remain as chairman of the board until his death, at which point his son Howard would assume that position.

Greg Abel: The New Captain of Berkshire's Ship

Greg Abel, 62, has been with Berkshire for over 25 years and currently serves as Vice Chairman overseeing the company's non-insurance operations. His selection as successor was first revealed in 2021 when Charlie Munger, Buffett's longtime business partner who passed away in November 2023, inadvertently mentioned Abel as the heir apparent during a meeting.

Abel's leadership style is described as methodical and detail-oriented, contrasting somewhat with Buffett's more folksy approach. Having overseen Berkshire's energy businesses and numerous other subsidiaries, Abel has demonstrated the operational expertise necessary to manage the conglomerate's diverse portfolio of companies.

Investors and analysts expect Abel to maintain the company's established practices of long-term investment strategies while continuing to withhold dividend payments to shareholders. Buffett emphasized that while he would remain available for consultation, the "final say" would rest with Abel once the transition is complete.

During the announcement, Buffett also made it clear he has "zero" intention to sell his Berkshire stock, providing additional reassurance to shareholders concerned about potential market disruptions following his departure.

A Legacy of Unparalleled Success

Buffett's decision to step down comes at a high point for Berkshire Hathaway, with the company's market value reaching approximately $1 trillion and shares trading at record levels. The timing reflects Buffett's often-quoted principle: "Be fearful when others are greedy, and greedy when others are fearful."

Born in Omaha in 1930, Buffett began his investment journey at the young age of 11, purchasing his first stock in 1942. His business acumen developed early, as he filed his initial tax return by age thirteen. Despite being recognized as one of the world's wealthiest individuals with a net worth of over $150 billion, Buffett has maintained a modest lifestyle, residing in the same unassuming home in Omaha for over 65 years.

Under Buffett's leadership, Berkshire has grown to encompass more than 60 subsidiaries, including insurance giant Geico, battery maker Duracell, and restaurant chain Dairy Queen. The company also holds significant investments in major corporations such as Apple, Coca-Cola, Bank of America, and American Express.

Market Reactions and Future Outlook

The announcement of Buffett's retirement elicited reactions from business leaders worldwide. Tim Cook, CEO of Apple, expressed on social media: "There has never been anyone like Warren, and many, including myself, have drawn inspiration from his insights. Knowing him has been one of the greatest privileges of my life."

While some analysts have questioned how Berkshire might evolve under new leadership, most expect continuity in the company's core philosophy. Abel's deep understanding of Berkshire's operations and culture positions him well to maintain the conglomerate's success.

The transition also raises questions about the future of Berkshire's massive cash reserves, which exceeded $167 billion at the end of March. Investors will be watching closely to see if Abel maintains Buffett's cautious approach to acquisitions or pursues a more aggressive investment strategy.

Buffett's retirement marks the end of the longest and most successful CEO tenure in modern business history, leaving behind a legacy that transformed not just a company but shaped investment philosophy for generations.