Table of Contents

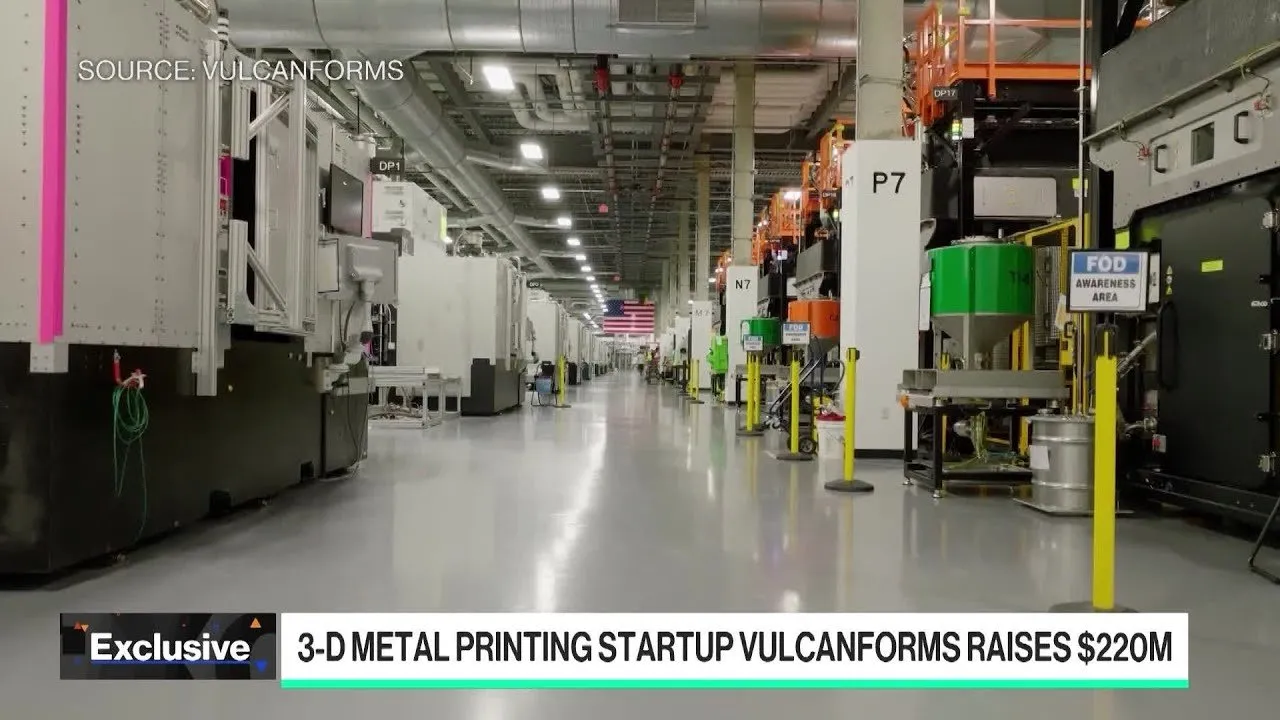

VulcanForms, an advanced metal product manufacturing company, has secured $220 million in a new funding round led by Eclipse and 1789 Capital to scale its industrial additive manufacturing operations. The capital injection will accelerate the company’s efforts to localize critical supply chains through its proprietary high-power 3D printing technology, aligning its expansion with national initiatives to strengthen domestic industrial capabilities.

Key Points

- Funding: VulcanForms raised $220 million in a round led by Eclipse and 1789 Capital, a firm where Donald Trump Jr. serves as a partner.

- Expansion Plans: Capital will fund the completion of facilities in Massachusetts, a new factory launching in July, and the design of a major US manufacturing campus.

- Technology Focus: The company utilizes the world’s highest-power 3D printing additive system to consolidate supply chains and reduce logistical inefficiencies.

- Strategic Alignment: The move supports broader US goals to reshore manufacturing and reduce reliance on complex global supply lines, including those involving China.

Scaling Domestic Production

The newly acquired capital is earmarked for immediate physical expansion. According to company leadership, the funds will drive the completion of "Vulcan 1" and the build-out of "Vulcan 2" in Newburyport, Massachusetts. Beyond these Boston-area facilities, VulcanForms is aggressively pursuing a broader national footprint.

The company confirmed that a third factory location is currently under construction and is scheduled to begin production in July of this year. Furthermore, plans are in the design phase for a significantly larger "campus-type location" situated elsewhere in the United States, signaling a move toward mass-scale industrial production.

"Our general North Star is we're an American advanced manufacturing company. We're very proud of that. So we partner with anyone who has interest in advancing exactly that cause."

Optimizing the Supply Chain

VulcanForms aims to disrupt traditional manufacturing by addressing the inefficiencies of global logistics. Company executives note that current metal supply chains can span over 20,000 miles and cross through nine different countries before a product is finished. In many cases, half of the product's cost is attributed solely to moving metal rather than adding value.

Leveraging experience from the semiconductor industry and previous roles at Tesla and Redwood Materials, the company’s leadership has focused on minimizing the distance "metal atoms need to travel." By utilizing high-power additive manufacturing, VulcanForms allows for the production of only what is needed, reducing waste and consolidating upstream and downstream processes.

"The most efficient way to make a product is to make only the product that needs to be made. And additive manufacturing allows for that... We've developed and innovated in that space to bring the highest powered, most productive platform to the market."

Geopolitical Implications and Market Strategy

The investment from 1789 Capital highlights the convergence of private equity and national political interests regarding industrial sovereignty. With Donald Trump Jr. as a partner at 1789 Capital, the funding round underscores a shared focus on "driving American manufacturing forward" and enhancing global competitiveness.

While acknowledging that exposure to foreign markets like China cannot be immediately reduced to zero, VulcanForms is working toward circular supply chains. The company is exploring the use of domestic titanium deposits and refining existing materials in circulation to reduce dependency on foreign raw materials.

As VulcanForms prepares to launch its third facility this summer, the company is positioning itself as a central player in the US manufacturing renaissance, aiming to couple technological innovation with supply chain security.