Table of Contents

US tariffs are inadvertently slowing the adoption of robotics, creating uncertainty for buyers and disrupting critical global supply chains. While ambitions for humanoid robots remain high, component sourcing issues and revised forecasts highlight the complex challenges facing the industry's growth.

Key Takeaways

- US tariffs create market uncertainty, discouraging investment in factory automation and robotics, especially in sectors like automotive.

- The robotics industry relies heavily on global supply chains, with China being a crucial source for essential components like actuators.

- Tariff-related cost increases or supply disruptions for components threaten to undermine US advancements in both industrial and humanoid robotics.

- Despite high-profile ambitions (e.g., Tesla's Optimus), even leading humanoid robot makers like UBTech are tempering near-term forecasts.

- China remains the dominant market for robot installation and a major manufacturing hub, while the US market lags significantly behind.

- Paradoxically, by slowing robot adoption, trade tariffs might temporarily preserve more manufacturing jobs in the US.

Tariff Uncertainty Dampens Robotics Demand

- Washington's tariff policies have injected significant uncertainty into the market, leading to hesitancy among potential buyers of industrial robots. Businesses facing unpredictable market conditions are less likely to commit to major capital expenditures like factory upgrades.

- The automotive sector, traditionally a major driver of demand for robotics, is particularly affected by trade tensions, clouding sales forecasts and discouraging investment in new automation technologies.

- This reluctance to invest extends beyond carmakers, potentially impacting various industries that could benefit from collaborative robots working alongside human employees, a focus for companies like ABB, Fanuc, and Kuka (now owned by China's Midea).

- The resulting paralysis on the shop floor means fewer orders for robot manufacturers, hindering the growth trajectory anticipated by industry leaders like Swiss group ABB, which recently celebrated selling 100,000 robots but whose robotics division remains a small part of its overall profit.

Global Supply Chains Under Strain

- The intricate nature of robotics manufacturing relies on globally distributed supply chains, making the sector particularly vulnerable to trade restrictions and tariffs imposed by policies like those from Washington.

- China plays a pivotal role as a key supplier of critical materials and components essential for robot production, creating a significant dependency for manufacturers worldwide, including those developing robotics within the US like Apptronik and Figure AI.

- Specific components heavily sourced from China include:

- Precision bearings used in actuators – the machines converting electrical signals into physical motion.

- Permanent magnets, highlighted by Elon Musk as a sourcing challenge for Tesla's Optimus humanoid robots.

- Actuators represent a substantial portion of production costs, estimated by Bank of America to constitute over half of the total material expenses, making tariffs on these inputs particularly damaging to manufacturers' bottom lines and potentially slowing innovation.

Humanoid Robot Ambitions Meet Reality

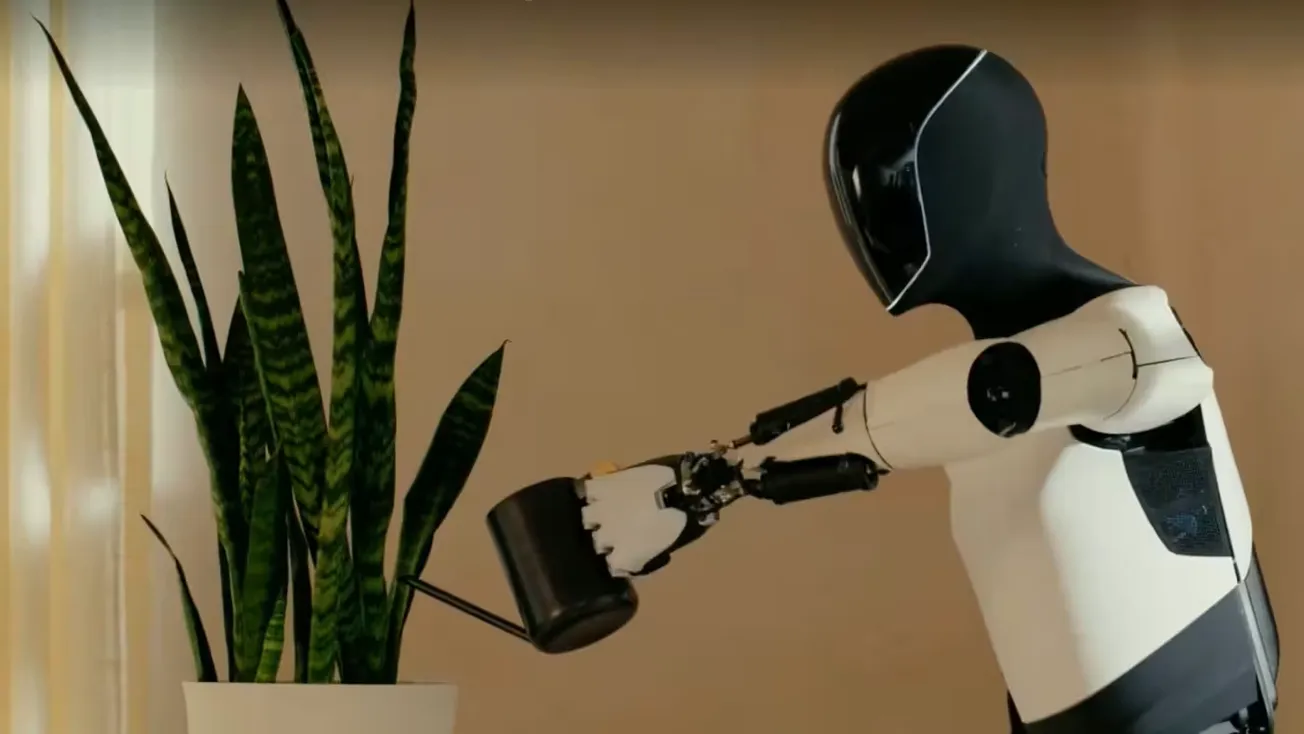

- Despite bold pronouncements, such as Elon Musk's goal of deploying one million Optimus humanoids by 2029 or 2030, the path for advanced humanoid robots faces significant hurdles related to both technology and market conditions influenced by trade policies.

- While the US shares a leading position with China in developing sophisticated humanoids equipped with AI and dexterous joints capable of human-like movement, supply chain issues and market realities are tempering expectations for rapid deployment.

- Shenzhen-based UBTech, a prominent player in the humanoid field with over 900 corporate clients globally upon its 2023 listing, recently scaled back its 2024 shipping forecast for industrial humanoids from a range of 500-1,000 units down to just 500.

- This adjustment prompted Citigroup analysts to significantly lower their revenue forecasts for UBTech, suggesting that the widespread adoption of humanoids in factories, hospitals, and homes may be further off than enthusiasts predict or hope for.

- While US firms like Apptronik and Figure AI contribute to innovation, reliance on international components makes domestic production susceptible to tariff impacts, potentially slowing progress and increasing costs for these futuristic machines.

Market Landscape and Unintended Consequences

- China dominates the global robotics market, accounting for over half of all industrial robot installations worldwide, underscoring its central role as both a primary consumer and a major producer in the sector.

- In manufacturing prowess for robots, China ranks second globally, producing significantly more units than third-ranked Germany, although still well behind leader Japan. The US market share remains comparatively small in this global landscape.

- Tariffs intended perhaps to bolster domestic industry risk delaying the adoption of efficiency-boosting robotics technology across the US economy, potentially harming long-term competitiveness rather than fostering growth.

- Ironically, one potential side effect of these trade barriers could be the preservation of American jobs in the short term, simply because the robots intended to augment or replace human labor will face slower deployment due to cost and supply chain friction.

Bottom Line

US tariffs are creating significant headwinds for the robotics industry, stifling demand through uncertainty and complicating vital global supply chains reliant on Chinese components. Ultimately, these trade policies may delay technological adoption and inadvertently slow the very automation they implicitly encourage, while perhaps temporarily preserving some jobs.