Table of Contents

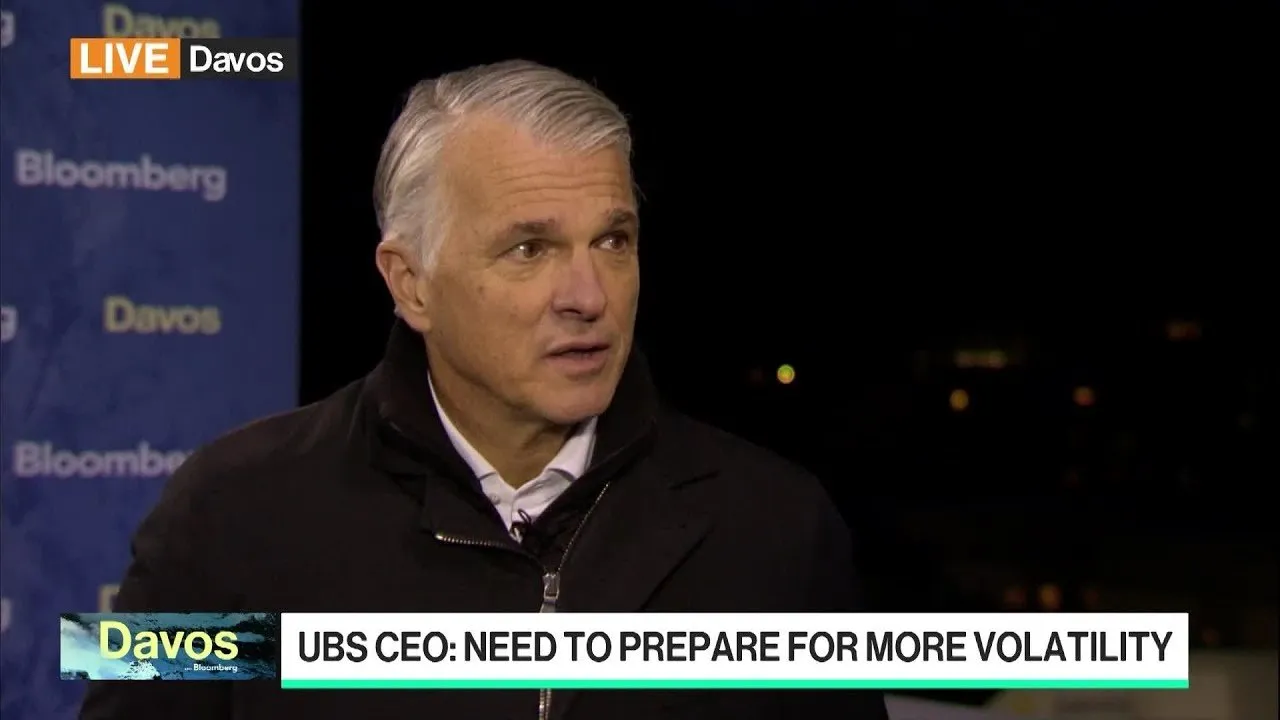

UBS Group AG CEO Sergio Ermotti has dismissed the notion of decoupling investment strategies from the United States, warning that diversifying away from American assets and the dollar remains a "dangerous bet" despite current geopolitical tensions and market volatility. Speaking on the sidelines of a major financial forum, Ermotti emphasized that the U.S. remains the undisputed driver of global innovation and wealth creation, making it an essential component of any major asset allocation strategy.

Key Points

- Strategic Warning: Ermotti labeled attempts to diversify away from the U.S. economy and the dollar as "impossible" and high-risk.

- Wealth Creation: The CEO highlighted that the U.S. created approximately 2.5 million new millionaires last year, underscoring the market's vitality.

- Integration Update: The complex integration of Credit Suisse is roughly 90% complete, though $3 billion in costs remain to be cut.

- Regulatory Outlook: Looming Swiss capital requirements remain a "cloud" over the bank, with clarity expected by the second quarter.

The Case for American Dominance

While some asset managers, including PIMCO, have discussed a multi-year period of diversification away from U.S. treasuries and assets, the head of Switzerland’s largest bank maintains a contrarian, bullish stance on the American economy. Ermotti argued that despite political rhetoric and short-term economic "bumps," the fundamental strength of the U.S. market is unmatched.

"Diversifying away from America is impossible. I think that in any major asset allocation, one could probably think about having an overweight or underweight, but diversifying away from the US and also from the dollar is a quite dangerous bet."

For UBS, the U.S. is not just a macro play but a critical growth engine. Ermotti cited internal data indicating that the U.S. minted roughly 2,500 new millionaires per day last year. Consequently, the bank plans to expand its market share in the region organically rather than through major acquisitions, focusing on enhancing product capabilities and strengthening the interaction between its investment bank and wealth management divisions.

Integration Progress and Regulatory Hurdles

Beyond market strategy, Ermotti provided a critical update on the historic integration of Credit Suisse. The process, which began following the government-brokered rescue in 2023, is entering its final, most difficult phase. While the integration is approximately 85% to 90% complete, the remaining workload involves complex structural changes, including the decommissioning of data centers and IT systems.

"We cannot be complacent... the last 15% is as important. We still need to take out 3 billion of cost and finalize the restructuring. And then we can... [be] prepared for growth."

However, domestic challenges persist. Ermotti acknowledged that potential new capital requirements from Swiss regulators hang like a "cloud" over the institution. He described the situation as a "political process" and expects to discern the "direction of travel" regarding these regulations by the middle of the second quarter. This regulatory uncertainty creates a distraction, though Ermotti insists it has not halted the bank's operational execution.

Succession and Future Leadership

As UBS stabilizes post-merger, attention has turned to the eventual succession of its leadership. Ermotti, who returned to the helm in 2023 to steer the bank through the crisis, suggested that the next transition should be seamless rather than disruptive. While the board has a duty to evaluate external candidates, Ermotti expressed confidence in his current team.

He advocated for an "evolution" rather than a "revolution" in leadership, implying a preference for internal promotion when the time comes. For now, the CEO remains focused on completing the restructuring and positioning the combined entity for long-term growth, viewing the successful stabilization of the Swiss banking sector as a defining element of his legacy.

Investors and analysts will be watching closely in the coming months as UBS finalizes its cost-cutting measures and navigates the forthcoming Swiss regulatory framework, both of which will determine the bank's trajectory into 2026.

![This Bitcoin Opportunity Will Set Up Many Crypto Traders For Success! [ACT NOW]](/content/images/size/w1304/format/webp/2026/01/bitcoin-short-squeeze-opportunity-100k-target.jpg)