![History Is Repeating For Bitcoin & Crypto! [Do This To Make Generational Wealth]](/content/images/size/w1304/format/webp/2026/01/history-repeating-bitcoin-crypto-wealth.jpg)

History Is Repeating For Bitcoin & Crypto! [Do This To Make Generational Wealth]

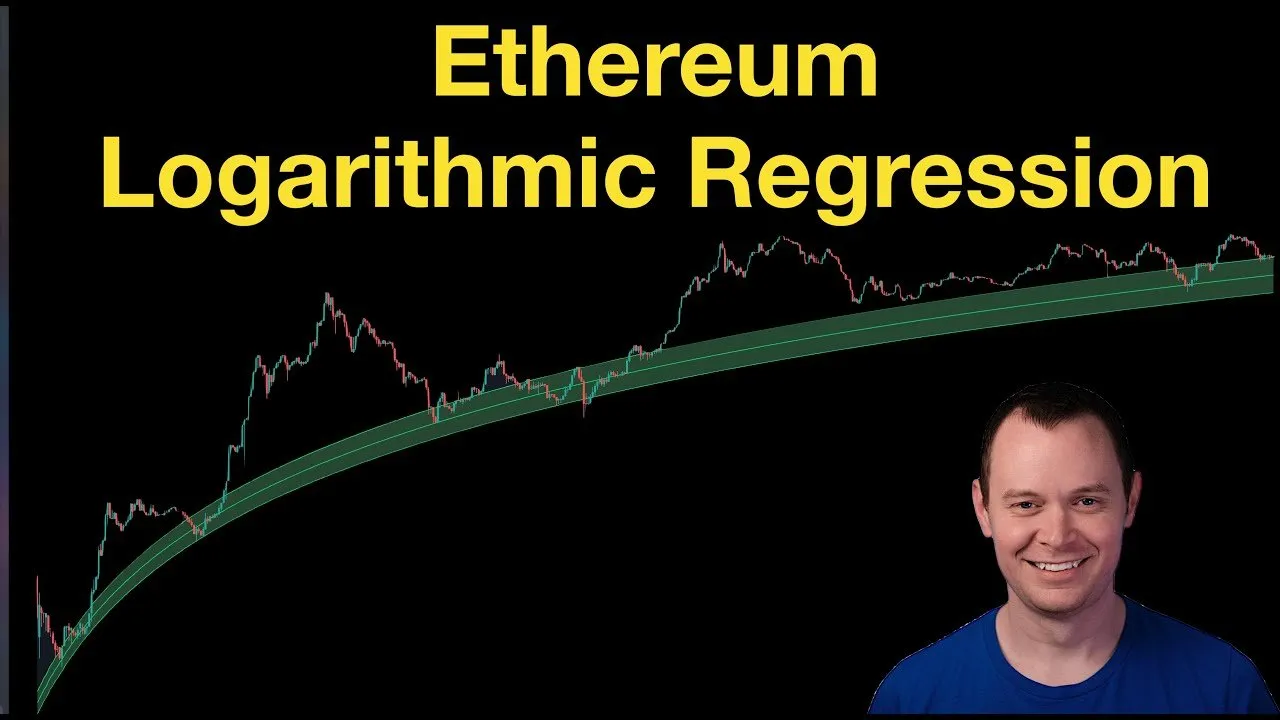

Global markets diverge as precious metals signal a top while Bitcoin consolidates. Analysts eye a silver correction as BTC targets $91,147. With the Dollar weakening, discover how historical fractals could define the next opportunity for generational wealth in crypto.