Table of Contents

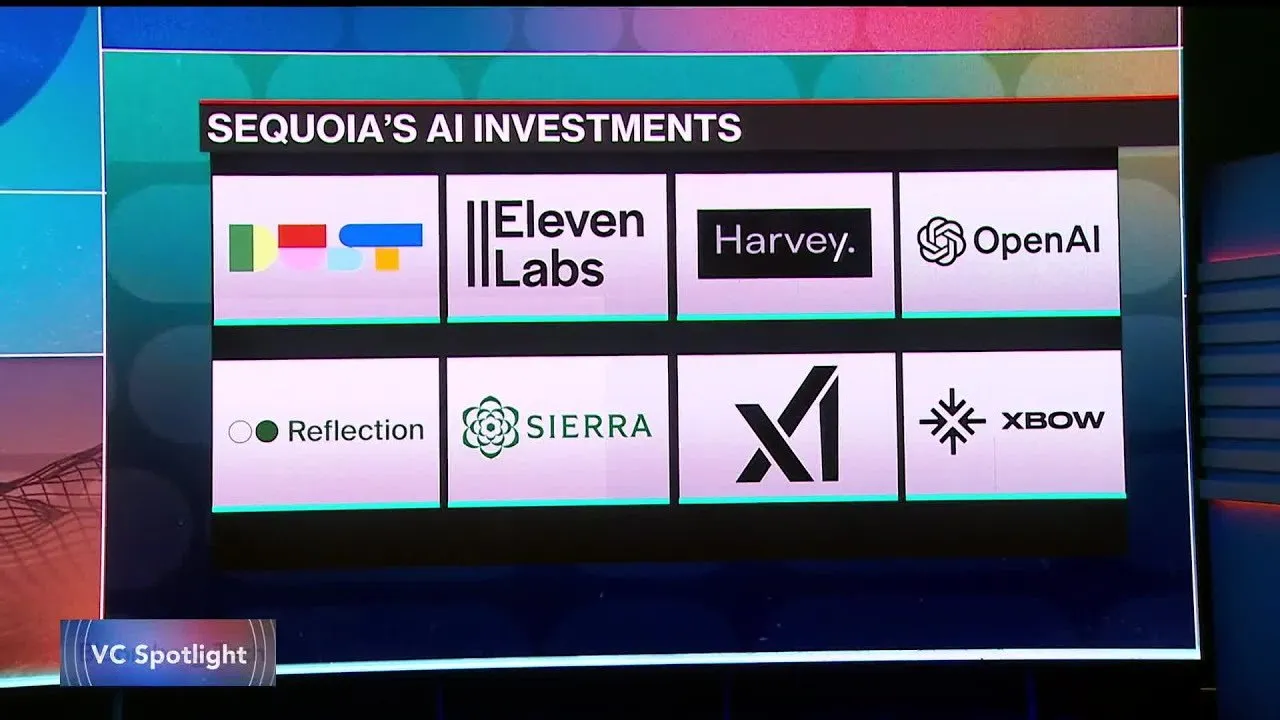

Sequoia Capital Partner Konstantine Buhler forecasts that 2026 will be defined by the rise of "Specialized Intelligence," a shift moving the industry beyond general large language models toward AI agents with deep expertise in specific sectors. In a recent analysis of market trends, Buhler highlighted how specialized tools in legal, security, and healthcare sectors are already outperforming human benchmarks and altering the early-stage investment landscape.

Key Points

- Strategic Shift: The focus of AI development is moving from generalist models to "Specialized Intelligence" (ASI) tailored for vertical-specific dominance.

- Proven Metrics: Specialized implementations are showing tangible ROI, with Waymo operating 10x safer than human drivers and Verkada accelerating security investigations by 30%.

- Digital Security: New AI penetration testing tools have surpassed human capabilities, ranking top on global leaderboards within 18 months of launch.

- Investment Litmus Test: Despite the trend of massive "coconut" seed rounds, Sequoia evaluates whether a startup remains a viable business even if the "AI" label is removed.

The Era of Specialized Intelligence

While 2025 showcased the power of general AI capabilities in coding and initial automation, Buhler predicts 2026 will be the year of "Specialized Intelligence." This evolution involves founders building deep, vertical-specific expertise rather than competing directly with foundational model giants like OpenAI, Google, or Anthropic. The market is rewarding companies that obsess over specific user needs, creating tools that integrate seamlessly into professional workflows.

One primary example of this vertical integration is Harvey, an AI platform designed specifically for the legal sector. By focusing strictly on legal workflows rather than broad applications, the company has secured over 1,000 customers.

"One of their customers said 'I would sooner lose my coffee for the year than my Harvey license.' My sister is a lawyer. She uses Harvey. She'd probably say the exact same thing."

High-Impact Vertical Applications

The transition to specialized AI is already delivering quantifiable improvements in both the physical and digital worlds. In the physical realm, autonomous driving technology has matured significantly, with Waymo vehicles now operating on city streets at safety levels ten times higher than the average human driver. Similarly, physical security firms are leveraging AI to maximize efficiency.

Verkada, a leader in AI physical security, has developed systems that extend the capabilities of human security teams. According to Buhler, their technology allows investigations to proceed 30% faster. This efficiency was recently demonstrated at a major airport where the technology accelerated the resolution of a bomb threat, allowing flights to depart on time.

In the digital sphere, cybersecurity is seeing rapid disruption. XPO, an AI penetration tester, reached human-level proficiency in finding vulnerabilities within six months. Within 18 months, it became the top-ranked entity on HackerOne, a global leaderboard for hackers, effectively outperforming human professionals in identifying and patching security gaps.

Navigating the 'Coconut Round' Economy

The surge in specialized AI has led to what industry insiders call "coconut rounds"—massive seed financing rounds that can reach hundreds of millions of dollars. While these figures suggest a frenzied market, Sequoia maintains a disciplined approach to capital allocation.

Buhler explained that the firm’s primary evaluation metric is business durability. The critical test for any potential investment is whether the company presents a sound business model even when the "AI" terminology is removed. Once that fundamental value is established, the firm evaluates whether the startup requires the capital scale typical of these large initial rounds.

Founders and Future Outlook

Looking toward 2026, the market opportunity lies in "courageous" founders willing to build alongside the major AI labs. Rather than being intimidated by the rapid progress of frontier models, successful founders are those who leverage deep domain knowledge to solve complex problems, such as Open Evidence in the healthcare space, which assists physicians in diagnosing complex medical issues.

"We encourage founders to be courageous in 2026. Know those areas deeply, specialize in that, delight your customers. And there will be amazing opportunity."

As the industry matures, the distinction between general AI hype and specialized value creation will likely become the defining factor for successful ventures in the coming year.