Table of Contents

Vinod Khosla reveals the storytelling secrets and presentation strategies that make VCs say yes, covering everything from slide design to investor psychology.

Learn the battle-tested framework that legendary VC Vinod Khosla uses to evaluate startups and how to engineer the perfect pitch.

Key Takeaways

- Investors make emotional decisions first, then use logic to justify them—appeal to both fear and greed

- Your presentation's narrative arc matters more than logical completeness or technical accuracy

- Every slide should pass the 5-second test—viewers must instantly grasp your core message

- Address risks directly rather than hiding them, as transparency builds investor confidence

- Practice on investors you don't want first to collect hard questions for your appendix

- Simplicity beats complexity—cognitive load kills investor interest and engagement

- Team alignment is critical—inconsistent answers between founders signal major red flags

- Your appendix should contain detailed answers to every possible objection or question

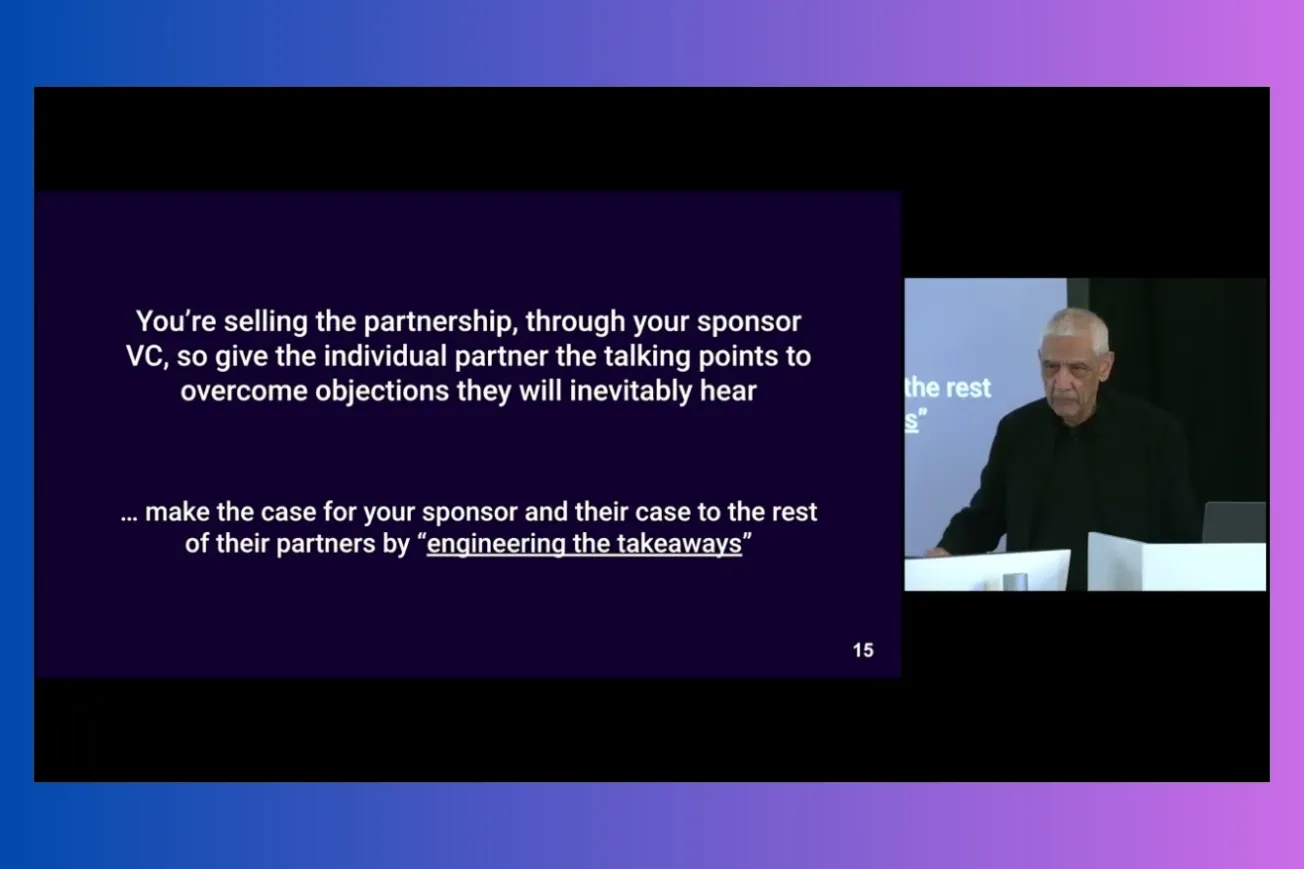

- The goal is engineering a positive takeaway email that sells your story to other partners

- 00:00–15:00 — Introduction to axioms: team prep, investor psychology, transparency principles

- 15:00–35:00 — Narrative storytelling framework, slide design principles, message clarity techniques

- 35:00–50:00 — Practical examples of good vs bad slides, simplification strategies

- 50:00–65:00 — Competition analysis, team presentation, financial modeling best practices

- 65:00–END — Appendix importance, pitch sequencing strategy, final recommendations

Core Presentation Axioms

- Team preparation eliminates the biggest presentation killer—inconsistent messaging between founders that signals poor internal alignment

- Investor psychology operates on just two emotions: fear and greed, with emotional decisions preceding logical justification every time

- Transparency about weaknesses paradoxically builds trust, while hiding problems guarantees investor suspicion and ultimate rejection

- Message complexity directly correlates with investor fear—the more nuanced explanations you provide early, the more likely rejection becomes

- Every interaction gets judged as a proxy for your leadership capability, strategic thinking, and ability to raise future rounds successfully

Your team's internal preparation process serves multiple critical functions beyond simple rehearsal. Different management team members often hold conflicting views about strategy, market size, or competitive positioning without realizing it. This misalignment becomes glaringly obvious during investor meetings when founders give contradictory answers to similar questions.

The preparation phase also creates a safe space for team members to voice concerns and potential risks. Andy Grove eliminated formal dress codes and executive parking specifically to encourage engineers to challenge leadership openly. This cultural foundation of constructive disagreement prevents costly surprises later.

Investor Psychology and Decision Framework

- Logical presentations mask the underlying reality that investors make gut decisions first, then construct rational explanations afterward

- Fear dominates the investment process—complexity, uncertainty, or hidden information triggers immediate rejection rather than deeper investigation

- Cognitive load from dense slides, technical jargon, or confusing graphics makes your business seem more difficult than it actually is

- The sponsoring partner must be able to sell your story internally to other partners using simple, compelling narratives

- Market risk and technical risk require different positioning strategies—high technical risk demands proof of low market risk

Investors evaluate hundreds of presentations monthly while entrepreneurs typically spend weeks perfecting a single deck. This asymmetry means investors default to pattern recognition and quick elimination rather than deep analysis. Your presentation must minimize cognitive effort while maximizing emotional engagement.

The psychological principle extends beyond presentations to actual business operations. A psychology study showed that changing task descriptions from clean fonts to script fonts doubled estimated completion time for identical tasks. Visual complexity unconsciously signals operational complexity.

Narrative Arc and Storytelling Structure

- Headlines alone should tell a complete investment story without requiring slide content or detailed explanations

- Start with your boldest claim, then systematically prove each supporting element throughout the presentation structure

- Omit information that interferes with narrative flow, even if logically relevant—completeness serves the story, not vice versa

- Each slide delivers one powerful message rather than multiple related concepts that dilute focus and impact

- The presentation arc mirrors "if I can prove X, then you should invest" with your closing slide confirming proof delivery

Effective presentations follow literary storytelling principles rather than logical business document structure. Write your key messages in a word document first, ensuring the headlines alone create investment desire. If this headline-only version fails to compel, no amount of slide design will compensate.

The narrative must hook viewers immediately. If investors cannot understand your business within five minutes, you have already lost. They hear thirty presentations monthly and lack patience for gradual revelation or complex setup.

Slide Design and Visual Communication

- The 5-second test determines slide effectiveness—show your slide to someone unfamiliar with your business, then remove it and ask what message they absorbed

- Visual clutter forces viewers to decide where to look, destroying the storytelling flow and creating decision fatigue

- Graphics only belong when they actively support your message rather than decorating or providing supplementary information

- Font choices and spacing affect perceived difficulty—script fonts make tasks seem twice as hard as clean, simple typography

- White space reduces cognitive load while excessive information density triggers subconscious complexity fears

- One message per slide enables faster pacing with higher comprehension than multiple concepts crammed together

Most entrepreneurs violate these principles by trying to demonstrate thoroughness through information density. This approach backfires because investors interpret visual complexity as business complexity. Your slides should punch emotionally rather than inform comprehensively.

The best slides often contain fewer than ten words with supporting visuals that reinforce rather than compete with the core message. Every element should serve the central narrative or be eliminated entirely.

Risk Management and Competitive Positioning

- Addressing risks proactively demonstrates business understanding while hiding them suggests naivety or deception to experienced investors

- Jack Dorsey's Square presentation began with "140 reasons this might fail," immediately building credibility and investor confidence

- Competitive advantages require proof rather than claims—show superior metrics, intellectual property, or strategic positioning through concrete evidence

- When advantages don't exist yet, transparency about building plans shows strategic thinking rather than weakness

- Risk mitigation strategies and contingency plans prove management sophistication and reduce investor fear about unknown challenges

The fear of discussing weaknesses stems from misunderstanding investor evaluation criteria. Sophisticated investors assume every business faces significant risks and challenges. They evaluate management teams based on risk awareness and mitigation strategies rather than risk absence.

Competitive positioning should focus on demonstrable advantages rather than feature comparisons. A healthcare company showing "$105,000 per discovered cancer vs our $184" provides more compelling evidence than detailed feature matrices that require analysis.

Team Presentation and Financial Modeling

- Team slides must communicate why this specific group can execute this particular vision rather than listing credentials or showing headshots

- Financial projections should emphasize business model advantages like improving unit economics with scale rather than detailed revenue forecasts

- Consistency across all numbers throughout your presentation signals preparation and honesty while contradictions suggest fabrication or carelessness

- Early-stage companies can demonstrate thoughtfulness about risk elimination and capital efficiency rather than established traction metrics

- Market segmentation should identify easier initial markets that serve as stepping stones to larger opportunities rather than immediate total addressable market capture

Team presentations fail when they try to be inclusive rather than strategic. Investors care about capability match with business requirements, not comprehensive staff representation. Focus on key contributors whose backgrounds directly enable your success hypothesis.

Financial modeling should tell the story of why your business becomes more valuable over time rather than providing detailed predictions that nobody believes anyway.

Common Questions

Q: How many slides should my VC presentation contain?

A: Slide count matters less than message clarity—Khosla covered 186 slides effectively because each contained one simple, powerful message.

Q: Should I include technical details in my main presentation?

A: No, technical accuracy belongs in the appendix while main slides focus on emotional engagement and business opportunity.

Q: How do I handle investor questions I cannot answer immediately?

A: Add appendix slides after each meeting to address new questions, demonstrating preparation for future investor conversations.

Q: What makes investors want to dig deeper into opportunities?

A: Bold claims backed by simple proof points that hook emotion first, then invite logical validation through detailed follow-up.

Q: When should I start practicing my investor presentation?

A: Practice on investors you don't want first to collect hard questions and refine messaging before approaching target investors.

Stories lure investors more effectively than facts, making narrative craftsmanship your most important fundraising skill. The framework transforms complex businesses into compelling investment opportunities through strategic simplification and emotional engagement.