Table of Contents

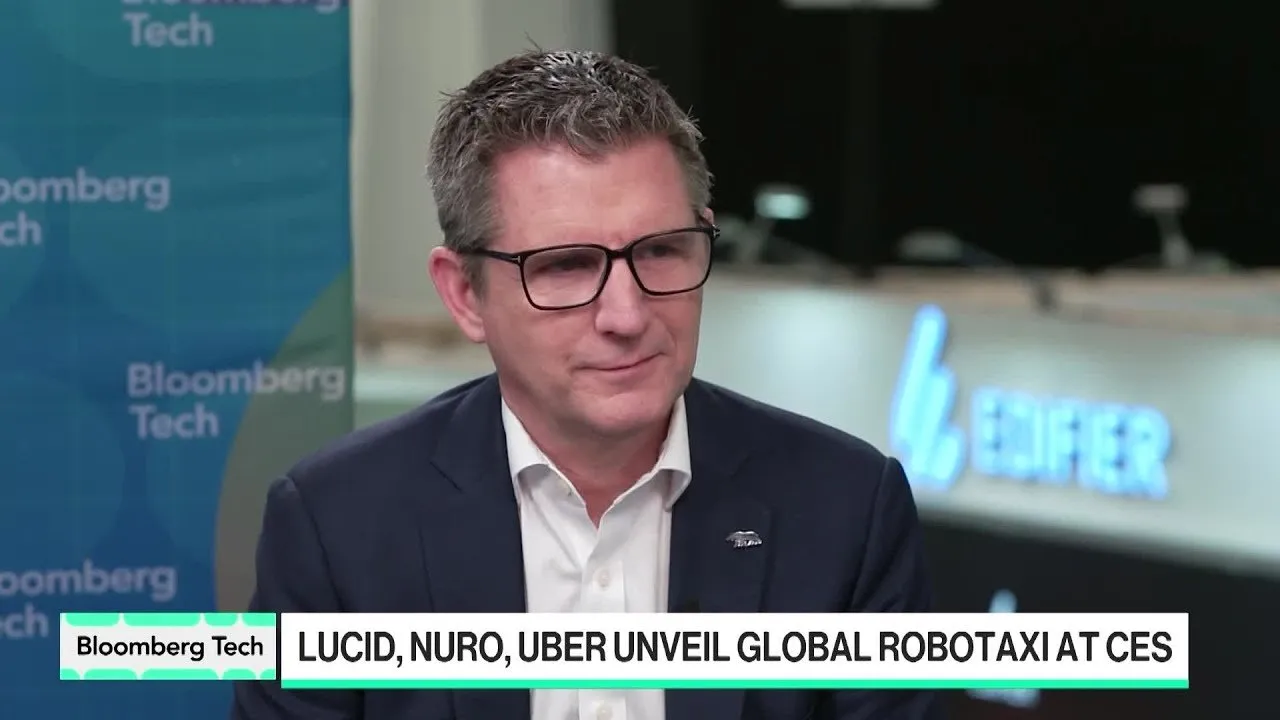

Lucid Group CEO Peter Winterhoff has announced an aggressive strategy to deploy a paid robotaxi service in partnership with Uber and autonomous driving firm Nuro by the end of this year. Speaking on the company’s trajectory, the chief executive detailed a dual-track approach that integrates rapid autonomous fleet deployment with a long-term consumer vehicle roadmap, while simultaneously executing a supply chain pivot to mitigate international tariff risks.

Key Takeaways

- Robotaxi Launch: Lucid plans to roll out a paid robotaxi service with Uber and Nuro within eight months, utilizing the Lucid Gravity platform.

- Autonomous Roadmap: The company is partnering with NVIDIA for consumer vehicles, targeting Level 3 autonomy by 2028 and Level 4 by 2029.

- Production Rebound: Following supply chain hurdles, Lucid reported its eighth consecutive quarter of record deliveries and a year-over-year production increase of over 100%.

- Supply Chain Localization: Battery production is shifting from Asia to the United States by mid-year to avoid trade war tariffs.

- Market Strategy: Lucid confirms it has no plans to enter the Chinese market or the sub-$30,000 vehicle segment, remaining focused on premium and luxury tiers.

Accelerating Autonomous Mobility

In a move to capture market share in the burgeoning autonomous transport sector, Lucid is expediting the integration of its electric vehicle technology with Nuro’s driver system. The collaboration, which includes Uber as the ride-hailing platform, aims to go from concept to a paid commercial service in less than eight months.

Winterhoff emphasized the speed of execution as a key differentiator for the partnership. By utilizing the Lucid Gravity—the company's luxury SUV—equipped with Nuro’s driver system, the company intends to offer a seamless, integrated user experience rather than a vehicle cluttered with aftermarket sensors.

"From when we all came together... to when we plan to roll it out by the end of the year in a paid service, actually, it's less than eight months. If you do that in that short period of time, that's actually a very unique thing by itself."

While the robotaxi initiative relies on Nuro, Lucid is pursuing a separate autonomous path for its retail consumer vehicles. The company is deepening its partnership with NVIDIA to power driver-assistance systems in its B2C offerings. The roadmap targets Level 3 autonomy—allowing "mind off" driving on highways—by 2028, with Level 4 capabilities projected for 2029, pending regulatory approval.

Production Recovery and Supply Chain Localization

Addressing the company's financial and operational performance, Winterhoff acknowledged the supply chain difficulties that plagued the previous year, specifically regarding the ramp-up of the Gravity SUV. However, the company appears to have turned a corner, citing an eighth consecutive quarter of record deliveries and a doubling of annual production figures.

To sustain this momentum and insulate the company from geopolitical trade friction, Lucid is actively restructuring its supply chain. A primary focus is the localization of battery sourcing. Currently imported from partners in Korea and Japan, battery production for Lucid vehicles is scheduled to move to the United States by the middle of this year.

"We are in process to localize this in order to not have to pay the tariffs... That will actually help already quite a bit. But there's still more work to do. We are making those decisions as we go in order to bring more things stateside."

Strategic Positioning in a Crowded Market

Despite the intensifying price war in the electric vehicle sector, Lucid is maintaining its focus on the premium and luxury segments. Winterhoff clarified that while the company plans to introduce a midsize platform targeting the $50,000 price point, there are no immediate plans to compete in the $20,000 to $30,000 mass-market bracket dominated by Tesla and Chinese manufacturers.

Furthermore, Lucid has ruled out an expansion into China, with Winterhoff citing the inability of Western OEMs to generate profit in that hyper-competitive market. The CEO argues that private vehicle ownership will remain vital alongside the rise of robotaxis, particularly for families and luxury consumers who value driving performance.

Moving forward, Lucid’s immediate focus will be the successful localization of its component manufacturing mid-year and the high-stakes execution of the Uber-Nuro robotaxi pilot before the year concludes.