Table of Contents

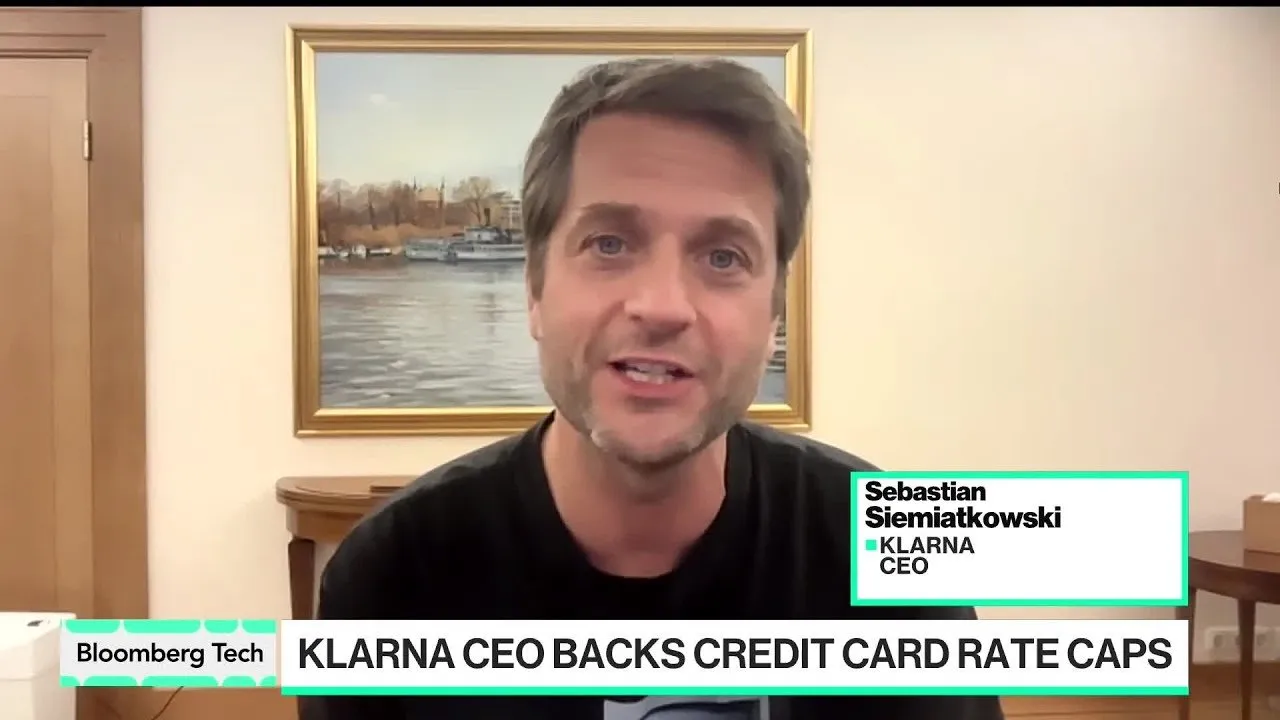

Klarna CEO Sebastian Siemiatkowski has publicly endorsed the proposal to cap credit card interest rates at 10 percent, characterizing the current United States financial services sector as an "extraction machine" designed to trap consumers in revolving debt. During a recent interview regarding the Trump administration's floated policy, Siemiatkowski argued that while such regulations would force shifts in the lending industry, they are necessary to curb a system that extracted $160 billion in interest charges from American households last year.

Key Points

- Industry Criticism: Siemiatkowski slammed the U.S. credit card industry for charging consumers $160 billion in interest and $31 billion in fees annually.

- Regulatory Compliance: Klarna committed to lowering the 29 percent APR on its own credit card product to comply with any new federal mandates.

- Wealth Transfer: The CEO cited Federal Reserve data suggesting credit card rewards function as a "regressive tax," redistributing $15 billion annually from lower-income to wealthy consumers.

- Operational Efficiency: Klarna reported a significantly lower charge-off rate (0.4 percent) compared to traditional banks (4.2 percent), attributing the difference to its installment-based model.

The "Extraction Machine" Argument

Siemiatkowski offered a stark critique of the traditional banking model, arguing that high interest rates are not merely a pricing mechanism for risk, but a fundamental flaw in the industry's design. He pointed to the massive revenue generated through interest and fees as evidence that the sector has prioritized debt maximization over financial service.

"That is not a financial services industry. It's an extraction machine. We've seen in Europe that putting interchange regulation and interest rate caps in place work really well."

The executive acknowledged that Klarna’s own credit card currently carries an Annual Percentage Rate (APR) of 29 percent, a rate that would be slashed under the proposed 10 percent cap. When pressed on whether Klarna would reduce its rates to meet such a mandate, Siemiatkowski responded, "Absolutely," noting that companies must adapt to regulations just as they do in other markets.

Reforming the Lending Model

The conversation highlighted the structural differences between Buy Now, Pay Later (BNPL) providers and traditional credit card issuers. While Klarna offers a credit card, the majority of its business relies on interest-free installment plans funded by merchant fees rather than consumer interest.

Siemiatkowski argued that the traditional credit card model is constructed to encourage revolving debt, where consumers pay interest on balances month after month. In contrast, he stated that Klarna’s average outstanding balance sits at approximately $100, compared to the industry average of $5,300 for credit cards.

"The whole credit card was constructed in a way that it's trying to get you to revolve every month... We don't offer revolving. We do installment based because it's safer and better for the consumer."

The Wealth Transfer Debate

A central pillar of Siemiatkowski’s argument focused on the economics of credit card rewards programs. Citing Federal Reserve data, he described these rewards systems as a mechanism that effectively transfers wealth from subprime borrowers to high-FICO score consumers.

According to the data referenced, the current system redistributes approximately $15 billion annually. High-credit consumers typically gain around $200 per year in rewards, while subprime consumers lose approximately $55. Siemiatkowski labeled this dynamic a "regressive tax," arguing that high interest rates on the poor are essentially subsidizing airline miles and perks for the wealthy.

Impact on Access to Credit

Critics of interest rate caps often argue that limiting rates will force lenders to restrict access to credit, potentially driving consumers toward predatory loan sharks. Siemiatkowski pushed back on this theory, suggesting that high interest rates are often a cover for inefficiencies and high loss rates within traditional banks.

He revealed that Klarna’s charge-off rate—the percentage of debt unlikely to be collected—is just 0.4 percent, compared to a 4.2 percent average for traditional banks. This discrepancy, he argued, proves that affordable lending is sustainable if the business model does not rely on maximizing consumer debt loads.

European Precedents and Future Outlook

Siemiatkowski drew parallels to European markets where interest rate caps are already in force. He noted that Germany maintains caps around 14 to 15 percent, while France enforces limits near 18 to 19 percent. According to the CEO, these regulations have proven effective without destroying the lending market.

Looking ahead, Klarna is observing the Trump administration’s proposals closely. While the implementation details remain unclear, the company identifies its core demographic as "self-aware avoiders"—a segment comprising roughly 20 percent of the population who have previously struggled with credit card debt and are now seeking safer financial tools.

As the regulatory environment potentially shifts, Siemiatkowski suggested that the industry will have to pivot away from high-interest revolving debt toward more transparent, installment-based lending structures.

![This New Bitget Platform Changes the Game [Literally Gold]](/content/images/size/w1304/format/webp/2026/02/bitget-launches-universal-exchange-gold-usdt.jpg)