Table of Contents

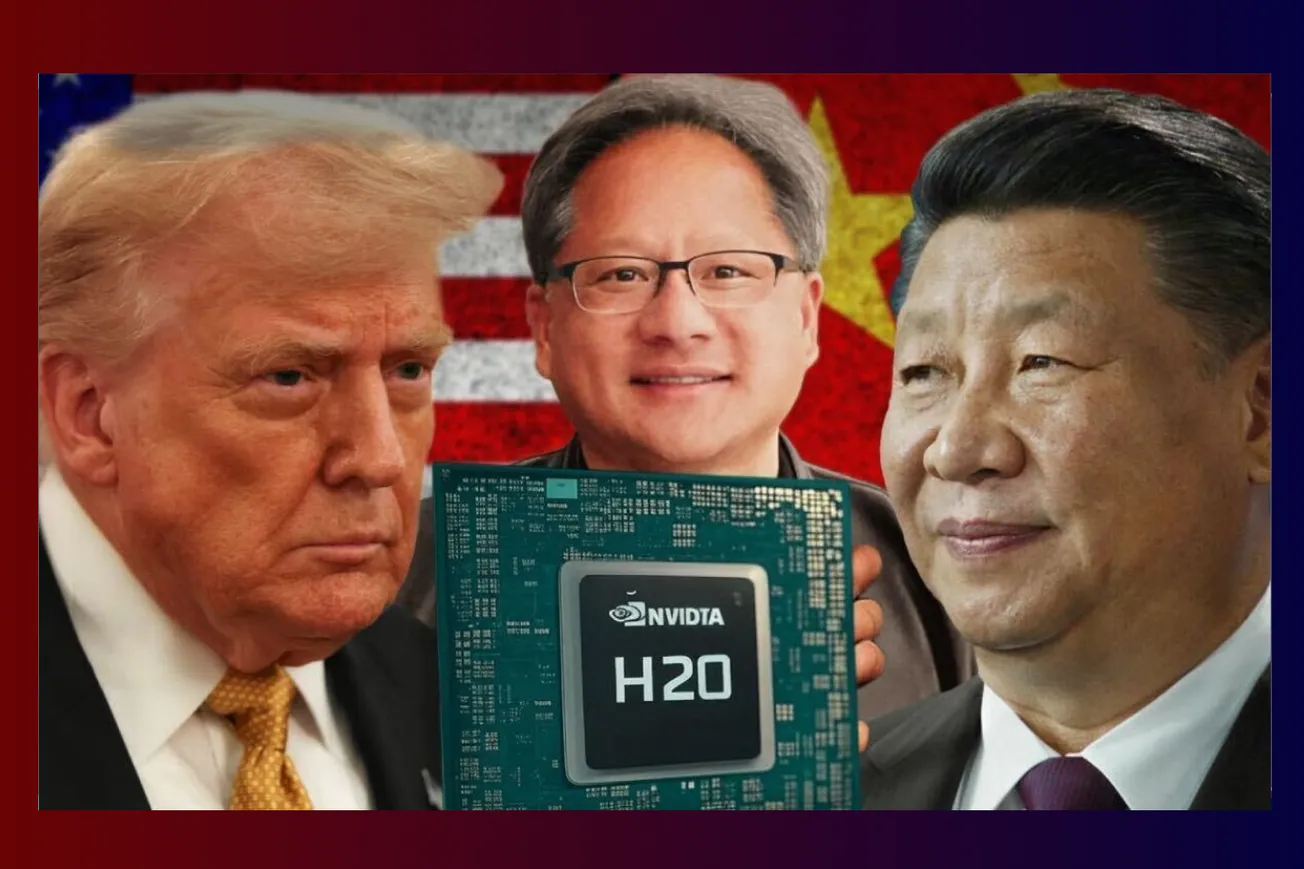

Expert analysis of Trump's controversial decision to allow Nvidia H20 chip sales to China with a 15% export fee, examining the technical capabilities, strategic implications, and political economy dynamics shaping America's AI export control policy.

Semiconductor experts Leonard Heheim and Chris Miller dissect Trump's reversal on H20 chip exports to China, revealing how technical misunderstandings, industry lobbying, and personalized diplomacy are undermining strategic export controls designed to maintain American AI leadership.

Key Takeaways

- Trump's characterization of the H20 as "obsolete" contradicts technical analysis showing superior memory bandwidth capabilities

- The H20 excels at AI inference and test-time compute despite training limitations, making it valuable for modern AI applications

- China can only produce 200,000 domestic AI chips annually while Nvidia could sell over 1 million H20s, creating massive capability gaps

- Industry lobbying dynamics favor GPU sellers over AI companies who face increased Chinese competition from H20 access

- Chinese government warnings about chip backdoors may be strategic theater to influence Washington's export control debates

- Export controls work best when applied to manufacturing tools rather than end products due to enforcement and substitution challenges

- Personal relationships between Trump and tech CEOs like Jensen Huang are shaping strategic technology policy decisions

- Cloud computing rentals could provide compromise solution allowing Chinese AI access while maintaining American control

Timeline Overview

- 00:00–18:30 — H20 Background and Initial Ban: Overview of Nvidia's export-control-compliant chip design, Trump's April 2025 ban, and reversal with 15% export fee

- 18:31–35:45 — Technical Capabilities Assessment: Detailed analysis of H20's memory bandwidth advantages versus computational limitations compared to Chinese alternatives

- 35:46–52:20 — Strategic Arguments For and Against: Examination of addiction theory, market share dynamics, and long-term competitive implications

- 52:21–68:55 — Political Economy of Export Controls: Industry lobbying patterns, company incentives, and relationship between different tech sector segments

- 68:56–85:40 — Chinese Government Response: Analysis of backdoor concerns, regulatory guidance, and strategic signaling from Beijing

- 85:41–END — Future Scenarios and Policy Alternatives: Discussion of cloud rental models, Congressional pressure, and potential policy changes

Technical Reality Versus Political Rhetoric

Trump's dismissal of the H20 as "obsolete" reveals fundamental disconnects between political messaging and technical analysis that could undermine strategic export control objectives.

- His claim that "China already has it in a different form" oversimplifies the substantial qualitative and quantitative gaps between Chinese domestic production and Nvidia's capabilities

- The assertion that Chinese companies "have a combination of two will make up for it" ignores critical bottlenecks in high bandwidth memory (HBM) access that cannot be easily substituted

- Trump's comparison to selling downgraded fighter jets demonstrates some understanding of export control principles while mischaracterizing the H20's actual performance profile

- His focus on computational performance (FLOPs) while ignoring memory bandwidth reflects incomplete technical briefings that miss the chip's primary competitive advantages

- The negotiation framing ("he said would you make it 15") reduces strategic technology policy to personal deal-making rather than systematic national security analysis

- His knowledge of chip names and competitive dynamics shows engagement with the issue while potentially being influenced by industry talking points rather than independent technical assessment

However, Trump's instinct that export controls should focus on more advanced chips like Blackwell rather than the H20 contains strategic logic. The challenge lies in his apparent misunderstanding of how the H20's memory bandwidth capabilities make it far from "obsolete" for modern AI applications, particularly inference and test-time compute that are increasingly important for AI development.

The Memory Bandwidth Advantage: Why Technical Specifications Matter

Leonard Heheim's technical analysis reveals how the H20's design creates capabilities that significantly exceed Chinese domestic alternatives in critical performance dimensions.

- The H20's 4 terabytes per second memory bandwidth using six HBM units exceeds even the H100's capabilities and dramatically outperforms any Chinese chip's 3.2 terabytes per second

- China's inability to purchase HBM since December 2024 creates fundamental bottlenecks that domestic production cannot quickly resolve, making memory bandwidth the critical constraint

- The chip's poor computational performance (7x worse than H100, 14x worse than upcoming chips) masks its effectiveness for AI inference and deployment applications

- The rise of test-time compute and AI models that generate extensive token sequences plays directly to the H20's memory bandwidth strengths rather than computational weaknesses

- Chinese companies' willingness to spend $15 billion annually on H20s despite having domestic alternatives demonstrates genuine performance gaps rather than mere convenience preferences

- The potential H20E variant using HBM3 technology could increase memory bandwidth to 5+ terabytes per second, further extending performance advantages over Chinese alternatives

The technical analysis exposes how political characterizations of "obsolescence" miss the nuanced performance profiles that matter for different AI applications. While the H20 may be poor for training large models from scratch, its memory bandwidth advantages make it highly competitive for the deployment and inference applications that increasingly drive AI value creation.

Strategic Logic of Export Control Frameworks

The debate between restriction and controlled access reveals competing theories about how technological dependencies create strategic leverage in great power competition.

- The "addiction theory" assumes that Chinese dependence on American chip architectures and software stacks (CUDA) creates long-term leverage that can be exploited during future crises

- Critics argue that China's existential priority in developing semiconductor self-sufficiency makes temporary dependence ineffective as strategic leverage since domestic capabilities will eventually emerge

- The "silicon shield" hypothesis linking Taiwan invasion risks to semiconductor dependence may overstate technology's role relative to broader political, military, and economic factors

- Export controls on manufacturing tools (EUV lithography) create more sustainable technological gaps than restrictions on end products that can be more easily substituted or reverse-engineered

- The quantity argument suggests that selling millions of H20s provides China with 5x more computing power than their domestic production capabilities, dramatically accelerating AI development timelines

- Cloud computing rental models could provide compromise solutions allowing Chinese access to computing power while maintaining American oversight and control mechanisms

However, the addiction theory faces fundamental challenges from China's demonstrated willingness to accept short-term technological dependence while building domestic alternatives. The semiconductor industry's exponential improvement curves mean that today's advanced chips become tomorrow's commodity products, suggesting that temporary export controls may delay rather than prevent Chinese technological progress.

Industry Lobbying and Political Economy Dynamics

The H20 controversy exposes how different tech industry segments have conflicting interests regarding export controls, creating complex lobbying dynamics that may not align with broader strategic objectives.

- Nvidia's financial incentives strongly favor maximizing chip sales, with the Chinese market representing potential billions in annual revenue from a single product line

- Hyperscalers and AI model companies face increased competition from Chinese firms with access to advanced computing hardware, creating incentives to oppose chip sales

- The 10-to-1 ratio of Nvidia employee donations to Harris over Trump suggests potential political preferences that may not align with current administration policies

- Companies dependent on Nvidia hardware (most AI firms) reportedly avoid public criticism of chip sales to avoid retaliation through reduced allocation priorities

- The timing of industry lobbying coinciding with trade negotiations creates opportunities for personal relationship leverage rather than systematic policy analysis

- Jensen Huang's direct access to Trump enables Silicon Valley influence on strategic technology policy through personal channels rather than institutional processes

The political economy reveals how concentrated industry interests (GPU manufacturers) may prevail over diffuse strategic concerns (national security) when policy decisions depend on personal relationships rather than institutional expertise. This dynamic risks optimizing for short-term commercial interests rather than long-term competitive positioning.

Chinese Strategic Response and Information Warfare

Beijing's public warnings about H20 chip security risks demonstrate sophisticated understanding of how domestic messaging can influence American policy debates while serving multiple strategic objectives.

- Ministry of State Security warnings about "digital spying via foreign produced chips" create domestic justification for preferring Chinese alternatives while potentially discouraging American sales

- Cybersecurity administration accusations about "kill switches" and remote control capabilities reference legitimate technical possibilities while potentially exaggerating actual risks

- State media emphasis on H20 energy inefficiency aligns with domestic industrial policy promoting Chinese chip development while providing rational justification for restrictions

- The timing of security warnings immediately following Trump's sales approval suggests coordinated messaging designed to influence American political debates about export control effectiveness

- Chinese government guidance discouraging H20 usage creates domestic market protection for Huawei and other domestic suppliers while maintaining plausible deniability about demand levels

- The strategic ambiguity allows Beijing to claim either that Chinese companies don't want American chips (if sales are restricted) or that security concerns require careful oversight (if sales proceed)

However, the underlying economic reality suggests strong Chinese demand for H20s despite public warnings. Private tech companies like Alibaba and Tencent operate under commercial incentives to acquire the best available hardware, and their substantial planned purchases indicate genuine performance advantages over domestic alternatives despite official skepticism.

Export Control Effectiveness and Enforcement Challenges

The H20 controversy reveals structural limitations in how export controls operate when applied to rapidly evolving technologies with complex supply chains and multiple potential applications.

- License requirements create administrative hurdles but may not prevent sales if political leadership favors commercial access over strategic restrictions

- The distinction between export control compliance (H20) and genuine technological limitations exposes how companies can engineer solutions that meet legal requirements while undermining strategic objectives

- Smuggling networks and third-country transshipment (Malaysia, Singapore) create enforcement challenges that reduce the effectiveness of formal export restrictions

- The speed of AI technological development means that today's controlled technologies may become obsolete before enforcement mechanisms can adapt to new capabilities

- Cloud computing architectures allow Chinese users to access American AI infrastructure remotely, potentially providing strategic benefits without direct hardware transfer

- Geographic proximity to Taiwan and South Korea creates opportunities for Chinese companies to access semiconductor supplies through regional partners rather than direct American sales

The enforcement challenges suggest that export controls work most effectively when applied to upstream manufacturing technologies (lithography tools) rather than downstream products (chips) that can be more easily substituted, smuggled, or accessed through alternative channels.

Alternative Policy Frameworks and Strategic Options

The discussion reveals several policy alternatives that could better align commercial interests with strategic objectives while maintaining American technological leadership.

- Cloud computing rental models would allow Chinese access to AI capabilities while maintaining American control over hardware location, usage monitoring, and potential restrictions

- Graduated restrictions based on end-user screening could prevent military and surveillance applications while allowing commercial AI development

- Higher export fees (beyond 15%) could generate revenue for strategic technology development while creating economic incentives for Chinese domestic alternative development

- Coordinated multilateral export controls with allies could reduce Chinese ability to source alternatives through third-country suppliers

- Investment in domestic AI infrastructure and research could maintain technological leads that make current export control debates less strategically critical

- Integration of export control decisions with broader trade negotiations could extract strategic concessions rather than simple revenue sharing

However, implementing alternative frameworks requires institutional capacity and political will that may conflict with the personalized, relationship-driven approach to technology policy demonstrated in the H20 decision. The challenge involves balancing legitimate commercial interests with strategic objectives through systematic rather than ad hoc policy processes.

Common Questions

Q: Is the H20 chip really "obsolete" as Trump claimed?

A: No. While inferior for AI training, the H20's superior memory bandwidth makes it highly competitive for AI inference and deployment applications.

Q: How many AI chips can China produce domestically versus importing from Nvidia?

A: China produces approximately 200,000 AI chips annually while Nvidia could potentially sell over 1 million H20s, creating a 5x capability gap.

Q: Do export controls actually work to maintain American technological advantages?

A: Controls work best on manufacturing tools rather than end products, but their effectiveness depends on enforcement and the availability of alternatives.

Q: Why did some AI companies stay quiet about H20 sales?

A: Companies dependent on Nvidia hardware reportedly avoid public criticism to prevent retaliation through reduced chip allocation priorities.

Q: What are China's real concerns about H20 chip security?

A: Chinese warnings likely combine genuine security considerations with strategic messaging designed to influence American policy debates and protect domestic industry.

The H20 controversy illustrates how technological complexity, industry lobbying, and personal relationships can override systematic strategic analysis in critical technology policy decisions. While the immediate commercial stakes may seem manageable, the precedent of subordinating export controls to trade negotiations and personal relationships could undermine broader frameworks for maintaining American technological leadership.

The case demonstrates both the promise and perils of export controls as strategic tools. When properly implemented with clear objectives and consistent enforcement, they can create meaningful technological gaps that advantage American competition. However, when subjected to political pressure and commercial lobbying without adequate technical expertise, they risk becoming ineffective theater that provides false confidence while failing to achieve strategic objectives.

Practical Implications

- For policymakers: Develop institutional processes for technology policy decisions that insulate strategic analysis from commercial lobbying and personal relationships

- For tech companies: Recognize that short-term commercial gains from Chinese market access may undermine long-term competitive advantages and strategic positioning

- For export control agencies: Focus enforcement resources on upstream manufacturing technologies rather than downstream products that can be more easily circumvented

- For Congress: Establish oversight mechanisms that prevent executive branch policy reversals based on industry pressure rather than strategic analysis

- For allies: Coordinate multilateral export control frameworks that reduce Chinese ability to source alternatives through third-country suppliers

- For researchers: Develop better frameworks for assessing the strategic impact of dual-use technology transfers beyond simple technical specifications

- For industry analysts: Examine how personal relationships between tech executives and political leaders may influence policy decisions in ways that diverge from systematic strategic analysis

The path forward requires balancing legitimate commercial interests with strategic objectives through institutional frameworks that prioritize long-term competitive positioning over short-term revenue optimization.