Table of Contents

History is often viewed as a sequence of wars and treaties, but it is perhaps more accurately understood as an evolution of "games"—systems of rules, incentives, and power structures that nations use to dominate the global stage. To understand the current geopolitical tension between the United States, China, and Russia, we must first understand the game that preceded our current era and how the United States rewrote the rules to create the first true global hegemony.

The transition from the British Empire to the American Superpower was not merely a transfer of territory; it was a fundamental shift in how power, money, and national identity are defined. While Britain built an empire on gold and ethnicity, America built a "continental fortress" based on fiat currency and meritocratic participation. Today, however, that system faces its greatest challenge as rival powers attempt to reset the board.

Key Takeaways

- The British Limitation: The British Empire failed because it was restricted by finite resources (gold), an exclusionary ethnic identity, and the geographical limitations of a small island nation.

- The Nation as a "Game": Unlike European powers defined by "blood and iron" or social contracts, America defined itself as an open "game" where citizenship is participation, and the primary rule is meritocracy.

- The Dollar Hegemony: The U.S. cemented global control by replacing gold with the U.S. Dollar, decoupling money from finite resources in 1971 and ensuring global demand through the petrodollar and trade agreements.

- The Price Hierarchy: The current global order is stratified with Finance at the top, followed by Knowledge, Manufacturing, and Resources at the bottom—a hierarchy now being challenged by Russia and China.

- The Great Reset: We are currently living through a "game reset" where emerging powers are attempting to break the dollar’s monopoly and restructure the global division of labor.

The British Prototype and Its Fatal Flaws

Before the American Century, the British Empire provided the blueprint for global dominance. Its success relied on three pillars that allowed a small island to control a vast portion of the globe: the Bank of England, which absorbed and protected foreign capital; Soft Power, exported through language, education, and culture; and the Royal Navy, which controlled the sea lanes and trade routes.

However, this prototype had three structural limitations that made it unsustainable in the long run.

1. The Trap of Ethnicity

Despite ruling a global population, the British Empire was inherently provincial. It was an empire of Anglo-Saxons ruling over others. This racial and ethnic exclusivity created a ceiling on cooperation. Local elites in India or Africa might collaborate with the British for profit, but they could never truly become British. This exclusionary mindset inevitably led to rebellion and the fracturing of the empire.

2. The Gold Standard

For centuries, wealth was synonymous with gold. While this provided stability, it also imposed a hard limit on economic expansion. There is only so much gold in the world. This meant the "game" of global economics was zero-sum; there was a cap on how many players could participate and how much wealth could be generated. It remained a game for the elite.

3. Geographic Constraints

Ultimately, Britain was a small island with limited natural resources and manpower. It was physically impossible for such a small landmass to indefinitely police the entire world against rising continental powers like Germany and Russia.

America’s Innovation: The Nation as a Game

When the United States superseded Britain, it resolved the three British limitations. Geographically, America is not an island but a "continental fortress" with effectively unlimited resources and control over the Western Hemisphere. But the true innovation was ideological.

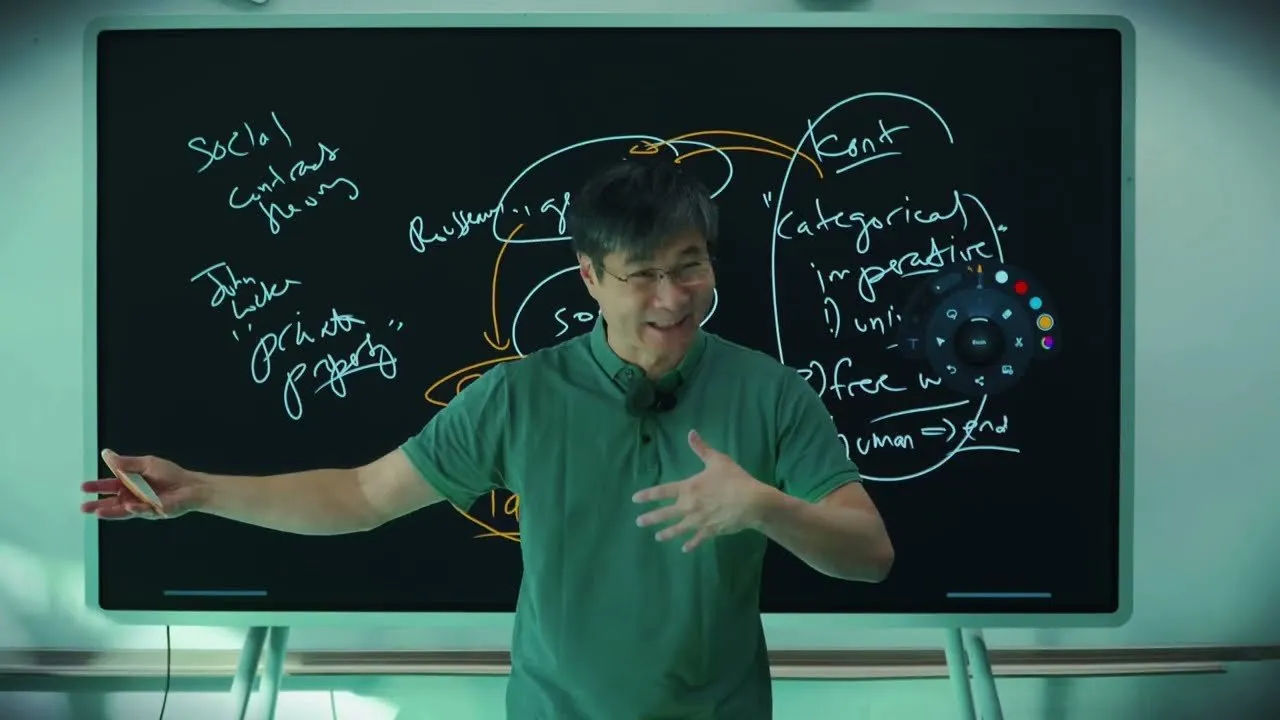

In the 18th and 19th centuries, Europe was debating what a nation should be. The French viewed the nation as a Social Contract (a generic will based on rights). The Prussians viewed the nation as Blood and Iron (heritage, language, and duty). America, facing a need for rapid expansion and population growth, took a different path.

The United States established itself not as a lineage or a contract, but as a Game.

"The concept that America creates is the idea of the melting pot... We welcome anyone who comes to America regardless of your race, regardless of your history, regardless of your wealth, as long as you're willing to assimilate into America."

To make this game work, the U.S. Constitution established three characteristics to incentivize participation:

- Openness: Anyone can play. This solved the British problem of ethnicity.

- Clarity: The rules (Rule of Law) are known and consistent.

- Fairness (Meritocracy): The only criterion for success is talent and hard work.

This structure unleashed immense energy. By treating the economy as a game where the most ambitious could win regardless of background, America generated the velocity required to overtake the older European powers.

Architecting Infinite Wealth: The Dollar System

With the physical frontier conquered, America needed to expand the game globally. The solution was to replace the finite constraints of gold with the infinite scalability of the U.S. Dollar.

Bretton Woods and the Institutions of Control

In 1944, the Bretton Woods conference established the dollar as the global reserve currency. To manage this new order, the U.S. helped create institutions like the World Bank (to issue loans for development) and the IMF (to restructure economies to align with the game). Later, systems like SWIFT centralized banking communication, ensuring that global trade flowed through American technological infrastructure.

The 1971 Pivot and the Petrodollar

The system faced a crisis in the Vietnam era. Excessive spending led countries like France to demand gold for their dollars. In 1971, President Nixon severed the dollar's link to gold. This turned the dollar into a fiat currency—conceptually, a "Ponzi scheme" relying entirely on future demand rather than present assets.

To ensure that demand remained high, the U.S. engineered the Petrodollar system with Saudi Arabia, requiring oil—the lifeblood of the global economy—to be purchased in dollars. Simultaneously, the U.S. opened its markets to China in the 1980s. The U.S. provided capital, technology, and military protection of shipping lanes; in exchange, China provided cheap goods and, crucially, adopted the U.S. dollar for trade.

The Price Hierarchy and the Coming Reset

Following the collapse of the Soviet Union in 1991, the U.S. established a "New World Order" based on a specific pricing hierarchy. This system assigns value in a pyramid:

- Top: Finance (The creation of capital) - Dominated by the USA

- Second: Knowledge (IP and Tech) - Dominated by the West/Europe

- Third: Manufacturing (Labor) - Dominated by China

- Bottom: Resources (Raw materials) - Dominated by Russia, Africa, South America

This division of labor functioned until the 2008 Financial Crisis revealed the instability of an economy focused purely on finance and speculation. The crisis was largely mitigated because China injected massive liquidity into infrastructure, essentially saving the global game. However, this shifted the balance of power.

The Challenge from the East

Having saved the economy, China sought a "seat at the table" as an equal. The U.S. response, beginning with the trade wars in 2016, was a refusal to alter the hierarchy. This has led to the current fracture.

Russia’s invasion of Ukraine can be viewed through this lens as a revolt of the "Resource" tier against the "Finance" tier. Russia and Ukraine combined control a massive percentage of the world’s carbohydrates and energy. By leveraging resources, they are challenging the assumption that finance sits atop the hierarchy. If you have money but no food or energy, the system collapses.

Conclusion: A World in Reset

We are currently witnessing a "Game Reset." The United States is fighting to preserve the integrity of the dollar system and its position at the top of the price hierarchy. Meanwhile, nations like China and Russia are attempting to diversify away from American hegemony—China through the Belt and Road Initiative and manufacturing dominance, and Russia through resource leverage.

The American game, which successfully integrated the world for nearly a century by offering open participation and infinite liquidity, is now facing competitors who no longer wish to play by rules they did not write. The outcome of this contest will define the economic and political structure of the 21st century.