Table of Contents

Defiance ETFs anticipates significant growth in leveraged single-stock funds and quantum computing investments as active ETF strategies continue their multi-year surge. The firm expects emerging themes including quantum technology and AI infrastructure to drive new product launches and investor interest throughout 2026.

Key Points

- Active ETFs maintained strong momentum in 2025, with billions flowing into leveraged single-stock and options-based products

- Quantum computing ETFs gained substantial investor interest, particularly after mid-2025, driven by commercial proof points

- New thematic opportunities emerging around quantum technology, 6G infrastructure, and AI-related debt markets

- Trump administration's December 20th announcement prioritizing quantum research expected to boost sector investment

- Investor base spans both retail traders and institutional clients with different risk profiles and time horizons

Active ETF Innovation Accelerates

The ETF landscape has undergone a dramatic transformation over the past two years, moving away from passive strategies that produced similar products across issuers. Leveraged ETFs experienced particularly strong performance in 2025, attracting billions in assets across both index-based and single-name funds.

According to industry analysis, investors gravitated toward innovative structures including single-name leveraged stocks and options-based products that generate income. This shift reflects growing sophistication among ETF users who seek differentiated exposure beyond traditional passive strategies.

The evolution extends beyond equity markets into fixed income, where AI-related debt has emerged as a potential thematic opportunity. While traditional bond ETFs dominate the space, specialized credit strategies focused on technology infrastructure financing could attract investor attention as AI companies increase borrowing to fund expansion.

Quantum Computing Gains Commercial Traction

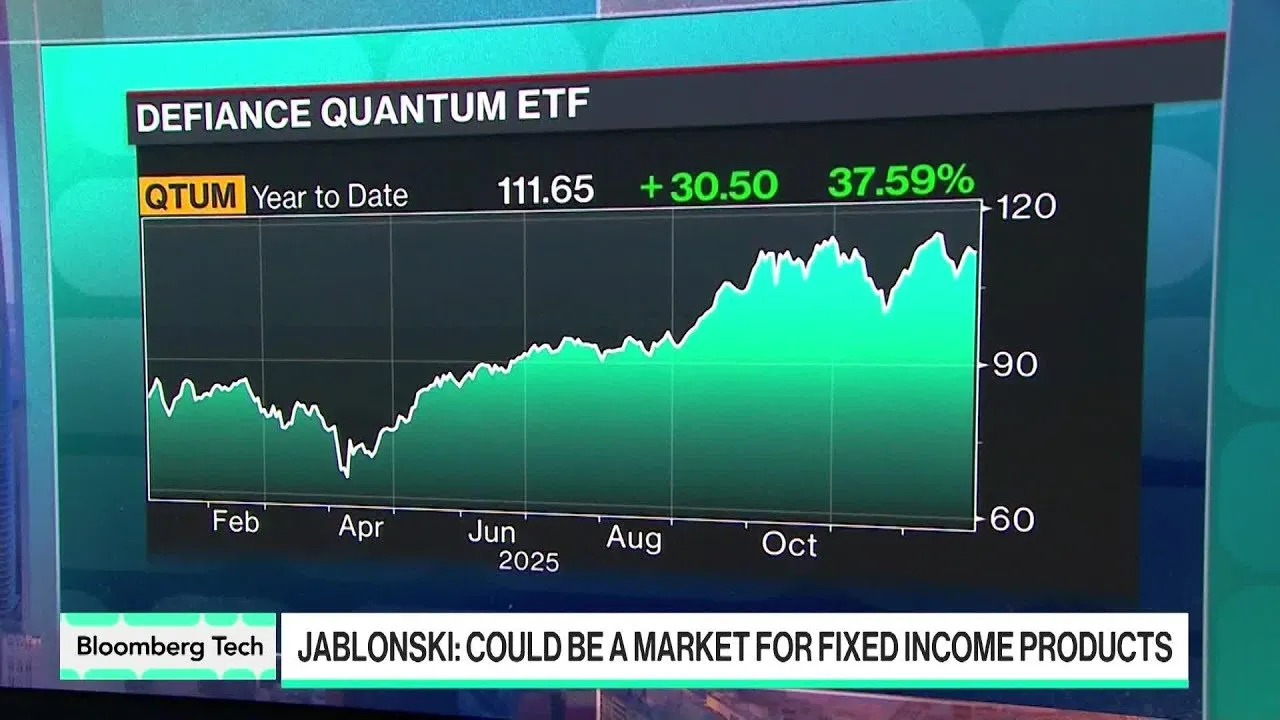

Defiance's Quantum ETF (QTU) captured significant inflows throughout 2025, with momentum accelerating during the summer months. The surge coincided with tangible commercial developments that moved quantum computing beyond theoretical applications.

We view this as a long term investment and in the last year, I think the reason that we've seen so much interest and so much inflow into the space is because you've started to get these proof points of reality and commercialization

Major technology companies including IBM, Cisco, and Oracle alongside Magnificent Seven firms have invested heavily in quantum services, making them available through cloud platforms like Amazon Web Services. Real-world applications such as bond pricing implementations with HSBC demonstrate the technology's emerging commercial viability.

The Trump administration's recent commitment to quantum research leadership, announced December 20th, provides additional policy support for the sector. This government backing could accelerate development timelines and attract institutional capital to quantum-focused investment vehicles.

Long-Term Investment Horizon Required

Despite recent progress, quantum computing remains in early development stages compared to artificial intelligence. Industry experts characterize AI as reaching toddler status while quantum technology is still learning fundamental capabilities. This positioning suggests patient capital and extended holding periods will be necessary for meaningful returns.

Strategic Product Development Approach

ETF issuers employ extensive due diligence processes before launching new products, analyzing volatility scores, social media interest, institutional demand, and media coverage. This research-driven approach aims to identify emerging trends before they achieve mainstream recognition.

However, even well-researched products may struggle initially before finding their audience. Some ETFs remain dormant for years before experiencing sudden growth spurts when market conditions align with their investment thesis. This phenomenon has created informal "Lazarus lists" tracking funds that resurrect after extended quiet periods.

The investor base for specialized ETFs varies significantly by strategy. Thematic products like quantum computing attract long-term, conservative investors seeking portfolio diversification. Conversely, leveraged single-stock funds appeal to sophisticated traders who understand the products' daily reset mechanics and short-term trading objectives.

Looking ahead, the convergence of government policy support, commercial quantum applications, and continued AI infrastructure buildout should provide multiple avenues for thematic ETF growth. The upcoming focus on 6G technology development, driven by quantum and AI advancement requirements, represents another emerging opportunity as 5G themes mature and evolve into next-generation connectivity solutions.