Table of Contents

At CES 2026 in Las Vegas, the technology sector signaled a decisive shift from digital generative AI to "physical AI," underscored by major hardware announcements from industry titans and significant consolidation in the robotics space. As geopolitical tensions simmered, the Nasdaq managed to hold gains, buoyed by Nvidia’s robust future roadmap and Mobileye’s strategic $900 million acquisition of Mentee Robotics, marking a new phase in the race to automate both factories and homes.

Key Points: CES 2026 Highlights

- Mobileye Acquires Mentee Robotics: The autonomous driving leader announced a $900 million cash-and-stock deal to acquire Mentee Robotics, aiming to apply its computer vision tech to humanoid robots.

- Nvidia’s Industrial Pivot: CEO Jensen Huang deepened ties with Siemens to integrate AI into industrial automation, while forecasting strong demand for the upcoming Blackwell and Rubin GPU architectures.

- Intel vs. Qualcomm on the Edge: Intel’s Client Computing Group revealed new chips built on its 18A process node to reclaim PC market share, while Qualcomm identified robotics as the next major frontier for edge AI.

- Market Resilience: Despite reports of China urging domestic companies to halt orders of Nvidia’s H-200 chips, U.S. tech indices remained near record highs.

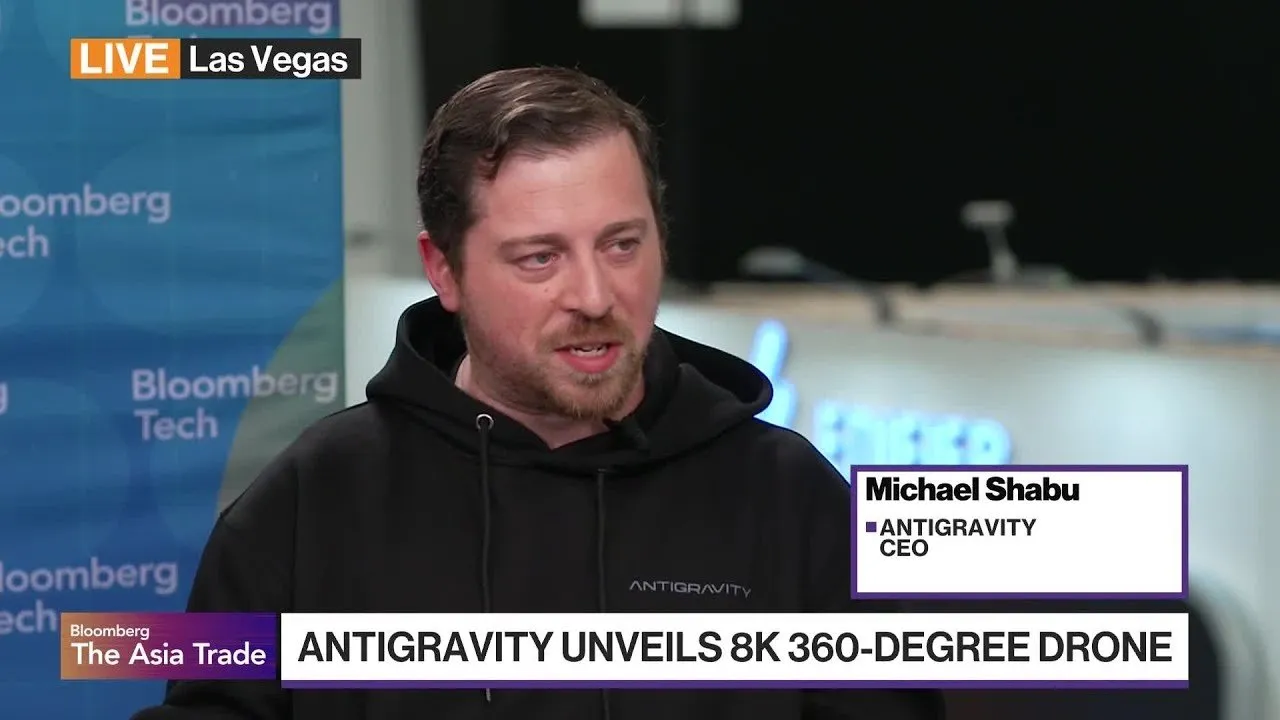

Nvidia Expands the "Industrial Revolution"

While geopolitical friction regarding chip exports to China provided a backdrop to the conference, Nvidia focused its narrative on the next generation of computing infrastructure. The company’s stock remained resilient, up nearly 1.5% during the session, as investors digested bullish forecasts for the Blackwell and Rubin GPU lines.

Nvidia CEO Jensen Huang utilized the event to highlight a deepening partnership with Siemens. The collaboration aims to accelerate the deployment of "physical AI" by integrating Nvidia’s simulation capabilities with Siemens’ industrial automation software. This move is designed to create "digital twins" of factories, allowing companies to simulate complex thermal and logistical properties before physical deployment.

"When you are done, each one of these Rubin GPUs is 240,000 watts. It is 10 times more energy efficient than the last generation. It is 10 times more cost efficient... This is about being able to do the impossible and being able to do it right the first time."

The company indicated that cloud pricing for its Hopper architecture is rising due to consumption saturation, suggesting sustained demand momentum as the market transitions to the H-200 and subsequent architectures.

Mobileye Bets $900 Million on Humanoids

In one of the event's most discussed transactions, Mobileye announced the acquisition of Mentee Robotics for approximately $900 million. The deal, expected to close in the first quarter of 2026, represents a significant pivot for the autonomous driving company into the broader field of robotics.

Mobileye CEO Amnon Shashua described the move as an essential expansion into "physical AI." He argued that the computer vision technologies developed for self-driving cars—spatial awareness, object recognition, and navigation—are directly transferable to humanoid robots.

"Mobileye wants not just another growth engine, but from a technological point of view, if you are an AI actor, you want to extend it to a full scope of physical AI. I believe that robotics, humanoids, they have a great future... For Mobileye, there are synergistic areas in AI and talents."

Shashua outlined a two-phase go-to-market strategy for the acquired technology. Phase one, slated for 2028, will focus on structured environments such as warehouses and assembly plants where tasks are finite. Phase two will target unstructured environments, eventually leading to domestic robots for home use. The company projects a manufacturing cost of approximately $20,000 per robot at volume, allowing for flexible leasing or sales models.

Addressing Governance Concerns

The deal faced scrutiny regarding related-party transactions, as Shashua was a co-founder of Mentee Robotics. Addressing these concerns directly, Shashua stated he recused himself from the negotiations and dismissed concerns regarding family involvement as immaterial to the strategic value of the acquisition.

The Battle for Edge AI: Intel and Qualcomm

Beyond the data center, the battle for dominance in "Edge AI"—processing artificial intelligence directly on devices like PCs and robots rather than in the cloud—intensified at CES.

Intel’s Turnaround Bid

Intel sought to prove its manufacturing resurgence with the launch of new mobile processors built on its 18A process node. Jim Johnson, of Intel’s Client Computing Group, claimed the new chips offer a 40% power reduction for workloads compared to the previous generation.

"It’s been a long journey to get here... We run workloads from last year at 40% lower power this year on this processor. I will take that system up against any of our competitors if you are into mobile gaming."

Intel is betting that "AI PCs" will drive a refresh cycle, leveraging local compute power for privacy, cost efficiency, and performance in applications like browser-based AI and gaming.

Qualcomm’s Robotics Push

Conversely, Qualcomm CEO Cristiano Amon positioned his company’s future not just in phones or PCs, but in powering the brains of the next generation of robots. Amon argued that robotics presents a quintessential "edge AI" problem requiring high-performance computing paired with low-power connectivity—Qualcomm's historic strongholds.

"We like robotics a lot because by definition it’s a huge edge AI problem to solve... You cannot put a server in a robot. You need battery life. Physical AI is a massive opportunity... Industrial robots are the largest opportunity that we see in front of us and probably start as early as 2026."

Market Implications and Venture Outlook

The hardware advancements at CES are occurring alongside a shifting financial landscape for AI companies. Hemant Taneja, CEO of General Catalyst, noted that while valuations for foundational model companies remain high, the market is beginning to distinguish between research projects and durable businesses.

Taneja highlighted Anthropic as a prime candidate for a public listing within the next 12 to 18 months, citing its capital efficiency and the growing adoption of its Claude model in engineering workflows. Simultaneously, sources indicate that messaging platform Discord has filed confidentially for an IPO, potentially signaling a thawing of the tech IPO market after a quiet period.

As 2026 progresses, the industry’s focus is clearly shifting from training AI models in the cloud to deploying them in the physical world. Whether through autonomous vehicles, factory twins, or humanoid helpers, the infrastructure built by Nvidia, Intel, and Mobileye will define the speed of this transition.