Table of Contents

The crypto landscape shifts dramatically as Bitcoin embeds deeper into US politics while economic storm clouds gather, threatening the entire digital asset ecosystem with potential recession.

Key Takeaways

- Three major macro catalysts threaten crypto markets: tariff-driven recession, American capital flight, and expanding global money supply

- Ethereum Foundation undergoes strategic pivot with new leadership emphasizing layer 1 scaling and product-centric development

- Trump administration positions Bitcoin as "digital gold" while pursuing aggressive accumulation strategy against other nations

- Worldcoin launches US retail expansion with Apple-like stores in six major cities offering eyeball scanning services

- Sui emerges as major mover with 40% rebound driven by DeFi ecosystem growth and Pokemon partnership speculation

Economic Storm Clouds Gathering Over Crypto Markets

The cryptocurrency sector faces unprecedented macro headwinds as traditional economic indicators flash warning signals. Recent GDP data delivered a shocking miss, recording negative 0.3% growth against expectations of positive 0.3% expansion, representing a substantial 0.6% variance that caught markets off guard.

- Tariff-driven recession risks escalate with baseline 10% levies now standard across trading partners, according to Treasury Secretary Scott Bessent's guidance as the "new normal"

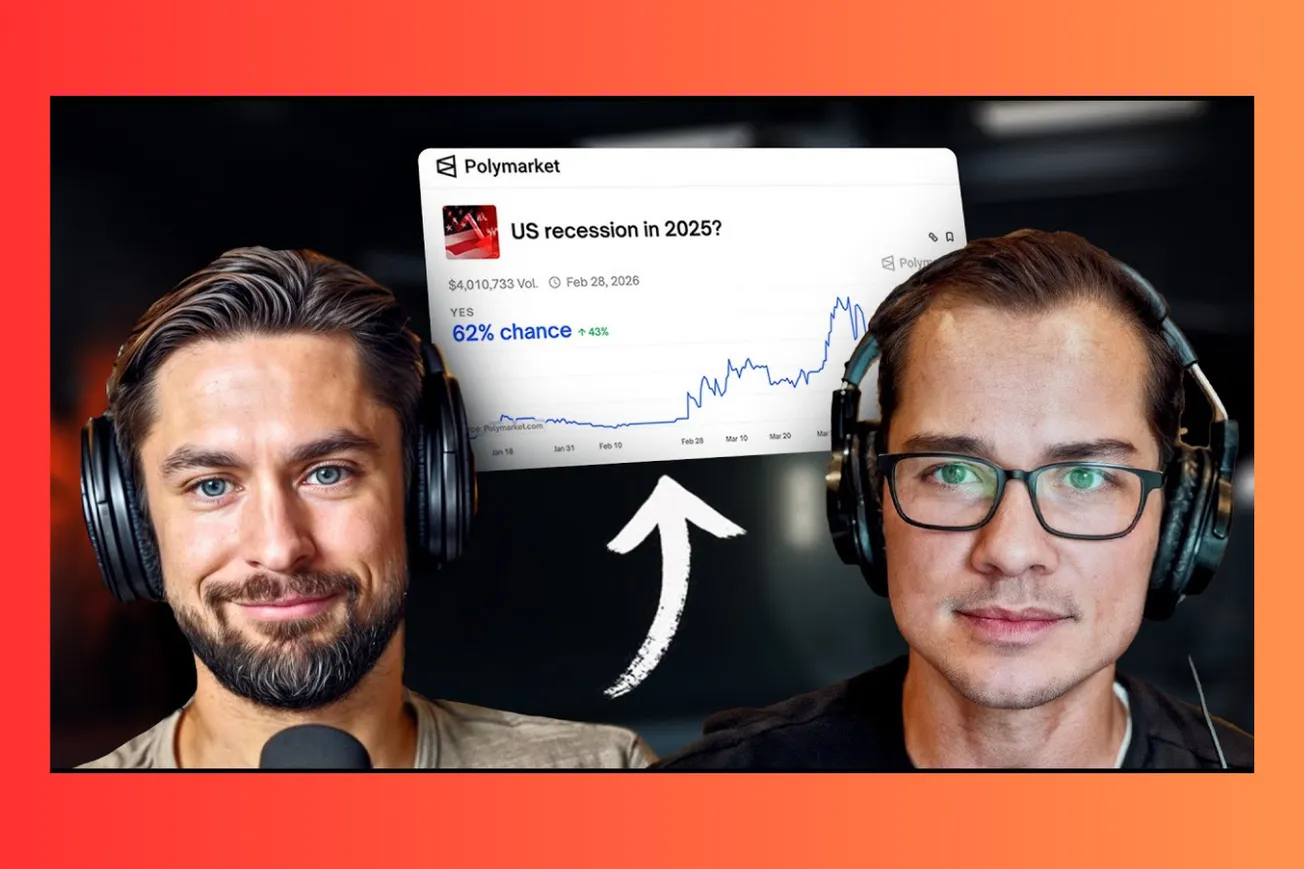

- Polymarket pricing indicates 62% probability of 2025 recession, with Apollo fund research predicting potential summertime economic contraction triggered by supply chain disruptions

- American capital flight accelerates as traditional safe havens show strain, with S&P 500 declining 4-5% and NASDAQ dropping 8% year-to-date despite historically resilient performance

- Bitcoin demonstrates increasing correlation with gold rather than NASDAQ, suggesting evolution toward sovereign store of value positioning during periods of economic uncertainty

- Global money supply bottoming creates potential liquidity catalyst, with M2 monetary base across all fiat systems entering new expansion cycle after years of contraction

- Trade war implications extend beyond immediate tariff impacts, as geopolitical realignment forces fundamental restructuring of international monetary relationships and dependencies

The Trump administration's tariff strategy creates ripple effects throughout the economy, with shipping container arrivals potentially halting by late May, followed by trucking demand collapse and retail layoffs entering early summer months. This timeline aligns with recession probability models while simultaneously driving demand for alternative monetary systems outside traditional government control.

Ethereum Foundation's Strategic Transformation Under New Leadership

Ethereum undergoes its most significant organizational restructuring since inception, with new co-executive directors Shiue and Tomas implementing product-focused governance changes. The foundation's board now includes Vitalik Buterin, Aya Miyaguchi, Patrick Stoneger, and Shiue, providing strategic oversight for the ecosystem's next evolution phase.

- Tomas introduces operational excellence methodology targeting specific deliverables over 12-month timeline, emphasizing scaling layer 1, scaling blobs, and user experience improvements

- Dankrad Feist proposes ambitious EIP for 100x Ethereum scaling over four years, stating "the current way of doing things is likely to make Ethereum irrelevant over the next 5 to 10 years"

- Cultural shift toward product-centric roadmap replaces previous rollup-exclusive focus, acknowledging layer 1 importance for maintaining ecosystem cohesion and fee generation

- Base and Scroll achieve stage one decentralization milestones, demonstrating reduced operator control and strengthened user asset protection through security council governance

- Community debates emerge over messaging strategy, with some advocating honest acknowledgment of strategic pivot versus face-saving "reprioritization" narrative

- Vitalik Buterin outlines 2025 focus areas including long-term layer 1 roadmap, single slot finality, statelessness implementation, and broader defensive acceleration (DACK) initiatives

The transformation represents recognition that fragmenting layer 1 liquidity across numerous layer 2 solutions weakens Ethereum's competitive position against unified blockchains. New leadership emphasizes committing to scaling timelines and planning backward from specific goals rather than incremental progress without clear targets.

Bitcoin's Political Integration Reaches Fever Pitch

The Trump administration elevates Bitcoin to unprecedented political prominence, with senior officials publicly positioning digital assets as strategic national priorities. Commerce Secretary Howard Lutnick explicitly frames Bitcoin acquisition as competitive advantage against other nations in emerging monetary competition.

- White House characterizes Bitcoin accumulation as "space race" similar to gold reserves, with officials stating "you want as much as you can possibly accumulate" of assets with intrinsic stored value

- Treasury Department tasked with developing "extremely creative ways" to acquire Bitcoin without direct taxpayer cost, leveraging existing government asset portfolios and revenue streams

- Current government holdings represent approximately 2.3% of total Bitcoin supply, primarily acquired through law enforcement seizures from criminal enterprises and darknet marketplace shutdowns

- Bitcoin increasingly trades in correlation with gold rather than technology stocks, reflecting shift toward sovereign store of value perception during economic uncertainty periods

- Regulatory framework positions Bitcoin as commodity similar to oil or gold rather than currency, providing legal clarity for institutional adoption and government reserve strategies

- International competition intensifies as other nations observe US accumulation strategy, potentially triggering global central bank Bitcoin adoption race similar to historical gold standard dynamics

The political endorsement represents culmination of decade-long Bitcoin advocacy efforts, with community successfully leveraging administrative transition to secure unprecedented government support. This marks fundamental shift from previous regulatory hostility toward explicit policy integration and strategic asset recognition.

Worldcoin's Retail Revolution Challenges Privacy Norms

Sam Altman's Worldcoin project launches comprehensive US market expansion through Apple-style retail locations offering biometric identity verification services. The initiative directly addresses growing AI bot proliferation while raising dystopian surveillance concerns among privacy advocates.

- Six major metropolitan markets selected for initial rollout: Atlanta, Austin, Los Angeles, Miami, Nashville, and San Francisco, featuring dedicated in-person verification centers

- New user incentives include 16 WLD tokens upon iris scanning with existing users receiving 150-token pioneer grants, representing $27-$150 value respectively at current market prices

- Strategic partnerships with Visa, Stripe, and Match Group integrate World ID verification across payment processing and dating platforms to combat bot infiltration

- Match Group integration addresses specific problem of dating app bots designed to manipulate human users, with verification providing authentic human confirmation

- Technical implementation maintains privacy through cryptographic hashing of biometric data rather than storing actual eyeball images, according to company security practices

- Community sentiment shifts toward acceptance as AI bot proliferation demonstrates practical need for human verification systems, despite initial dystopian aesthetic concerns

The retail expansion coincides with growing recognition that traditional CAPTCHAs and verification methods fail against sophisticated AI systems. Worldcoin positions itself as civilizational defense mechanism against AI-powered manipulation campaigns across social media, dating, and commercial platforms.

Market Dynamics Reveal Shifting Crypto Landscape

Cryptocurrency markets demonstrate divergent performance patterns as institutional adoption accelerates alongside retail speculation. Sui Network emerges as standout performer through strategic positioning and ecosystem development, while traditional privacy coins experience unexpected revival.

- Sui rebounds 40% to $3.6 following January all-time high decline, driven by DeFi ecosystem surging past $2 billion total value locked through protocols like Aftermath and Steamfy

- Gaming console launch strategy with SuiPlay0X1 device represents novel approach to blockchain adoption through dedicated hardware ecosystem integration

- Pokemon partnership speculation drives additional price momentum, though official confirmation remains pending regarding digital collectibles collaboration

- Monero surges 50% during $33 million Bitcoin theft laundering operation, highlighting continued demand for privacy-focused cryptocurrency infrastructure despite regulatory pressure

- Canary Capital files first-ever Sui ETF application with SEC, suggesting institutional product development beyond established Bitcoin and Ethereum investment vehicles

- Movement Labs faces investigation over $66 million token dump through allegedly predatory market maker agreements, raising questions about launch practices and token distribution ethics

The performance divergence reflects maturing market recognition of fundamental utility versus speculative positioning. Established ecosystems with genuine adoption metrics increasingly separate from pure narrative-driven assets as institutional evaluation criteria become more sophisticated.

Regulatory Landscape Transforms Under New Administration

The Trump administration implements sweeping changes to cryptocurrency regulatory framework, reversing previous restrictions while establishing new governance structures. Congressional initiatives target government official trading practices affecting all asset classes including digital currencies.

- Federal banking regulators rescind guidance requiring permission for crypto activities, allowing banks to engage directly without prior approval from Fed, FDIC, and OCC

- Senator Josh Hawley introduces "Pelosi Act" preventing elected officials from owning securities and investments, addressing insider trading concerns across all asset classes

- Two stablecoin bills advance through Congress: the "Stable Act" and "Genius Act," with naming conventions reflecting political messaging strategies

- Circle rejects Ripple's $4-5 billion acquisition attempt, maintaining independence despite regulatory uncertainty and competitive pressure from Tether's profit advantages

- Alex Mashinsky faces 20-year prison sentence recommendation for Celsius fraud involving $4.7 billion in user losses, with sentencing scheduled for May 8th

- Sam Bankman-Fried's 25-year sentence faces reconsideration discussions as FTX bankruptcy proceedings successfully recover user funds through Anthropic investment returns

The regulatory transformation extends beyond cryptocurrency-specific rules toward broader financial system integration. New frameworks position digital assets within existing commodity and securities law rather than creating parallel regulatory structures, suggesting long-term institutional legitimacy recognition.

The cryptocurrency ecosystem stands at an inflection point where traditional economic forces collide with revolutionary technology adoption. While short-term recession risks threaten all risk assets, the fundamental thesis of decentralized alternatives to government-controlled monetary systems gains validation through official policy integration. Bitcoin's political ascendancy and Ethereum's strategic refocusing position both networks for sustained institutional adoption regardless of temporary market volatility.