Table of Contents

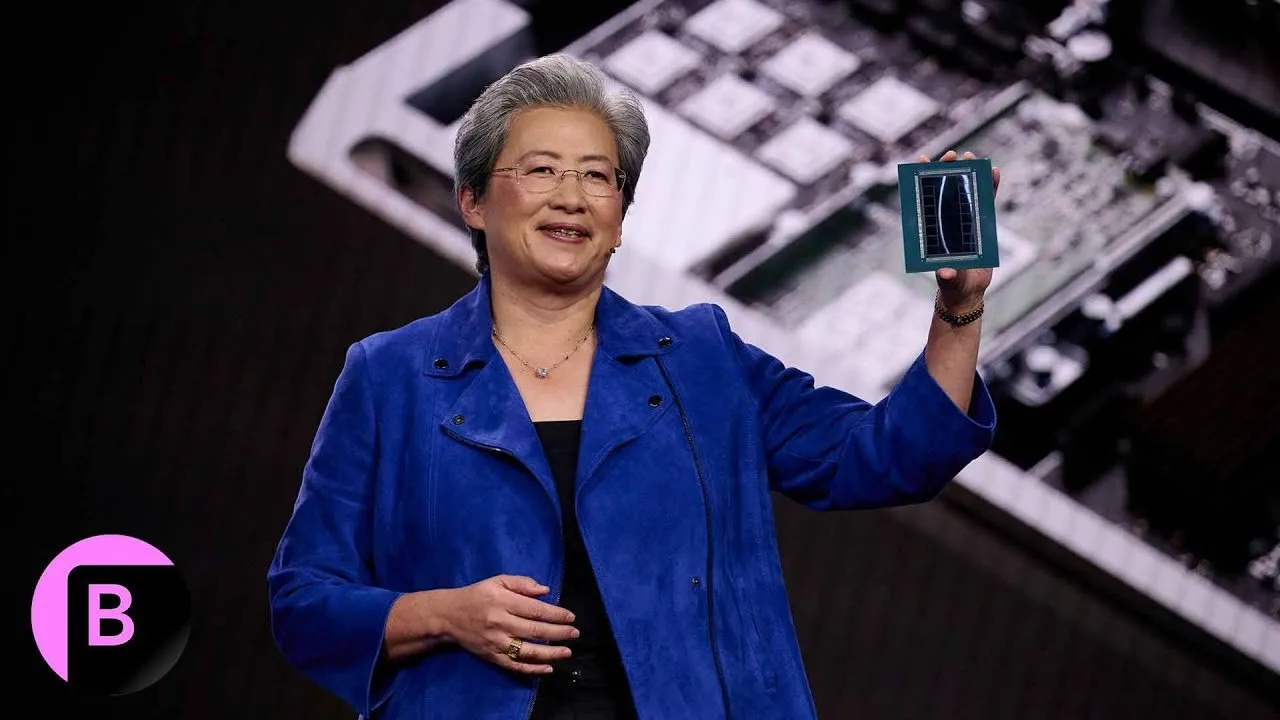

AMD CEO Lisa Su unveiled the company’s next-generation Instinct MI455X accelerators at CES, signaling a significant leap in performance designed to challenge Nvidia’s market dominance. The announcement coincides with Nvidia’s accelerated timeline for its Vera Rubin platform, highlighting an intensifying battle for leadership in the trillion-dollar "physical AI" and data center sectors.

Key Takeaways

- AMD Innovation: The new Instinct MI455X accelerator, part of the Helios system, represents the company's largest generational performance increase to date.

- Nvidia's Surprise Move: Nvidia accelerated the timeline for its Vera Rubin chips, targeting autonomous systems and robotics earlier than the market anticipated.

- Market Segmentation: Analysts see a three-way divergence: Nvidia focusing on full-stack ecosystems, AMD providing high-performance alternatives, and Intel leveraging federal support for domestic manufacturing.

- Capital Expenditure: Data center commitments in the Western world are projected to reach $61 billion this year as demand outstrips supply.

The Rise of Physical AI

While AMD focused on raw performance gains, the broader market narrative at CES shifted toward "physical AI"—autonomous vehicles, robotics, and devices capable of independent reasoning. Ray Wang, founder of Constellation Research, identified this as the next major growth vector for the semiconductor industry.

According to Wang, Nvidia is aggressively positioning itself to capture this market by expanding beyond simple chip manufacturing into a full-stack ecosystem provider. This strategy includes software, hardware, and device partnerships, such as those with Mercedes-Benz and Siemens.

"This is the next trillion-dollar market opportunity... That means autonomous vehicles. That means robotics. That means other devices that are controlled and actually moved using AI and chips that reason on their own. This is the game changer that we are looking for."

The introduction of the Vera Rubin platform—announced months ahead of the expected timeline—demonstrates Nvidia's intent to maintain its valuation premium. The new architecture boasts five times the performance of its predecessor while using only 1.6 times the transistors, channeling one trillion parameters to drive extreme efficiency.

AMD’s Strategic Counter

AMD is countering Nvidia's ecosystem play by focusing on high-performance alternatives necessary to prevent a market monopoly. During her presentation, Su highlighted that the Helios system requires innovation across hardware, software, and systems engineering. The Instinct MI455X is positioned to offer the efficiency and availability that hyperscalers and data centers desperately need.

The market dynamics suggest that while Nvidia dominates, customers are actively seeking diversification. Wang noted that the industry is not yet a "winner-takes-all" scenario due to the sheer volume of demand.

"You're going to see a competitor on the other end in terms of ability to get production in play... It's an important piece for anybody to show that they are the alternative to Nvidia on the GPU side."

Diverging Chip Strategies

The semiconductor landscape is fracturing into distinct strategic lanes. Nvidia is moving deeper into the "physical ecosystem," transitioning from training-focused GPUs to inference-heavy applications that compete with Google's TPUs. Meanwhile, Intel is carving out a niche supported by the CHIPS Act, focusing on domestic manufacturing and a state-sponsored approach to supply chain security.

As the industry moves from AI model training to inference (the application of AI in real-world scenarios), the efficiency of chips like AMD's MI455X and Nvidia's Rubin will be the primary battleground. With over $61 billion in data center commitments slated for this year alone, the pressure is on manufacturers to deliver hardware that can handle exponential workload growth without prohibitive power consumption.