Table of Contents

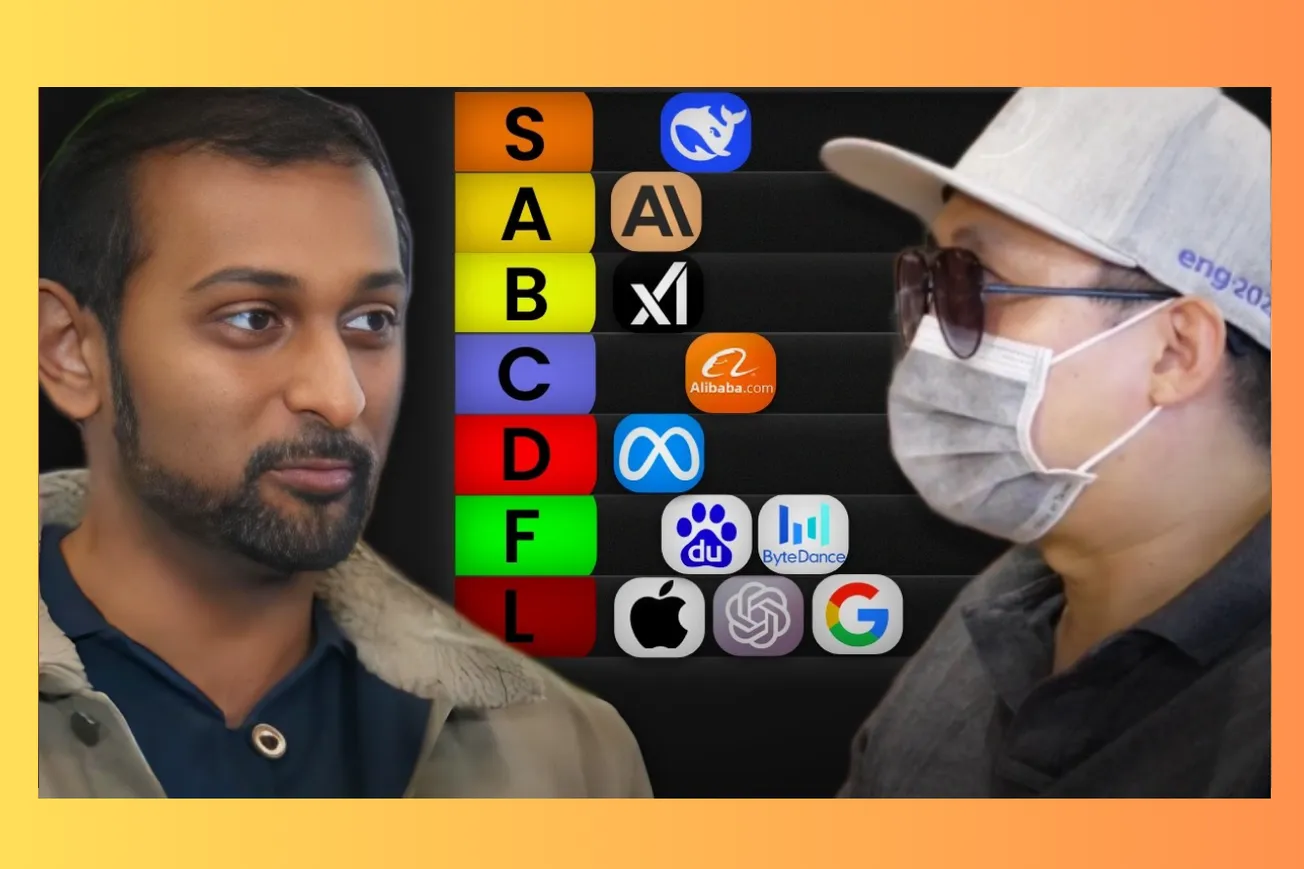

Dylan Patel and the Asianometry team deliver their quarterly AI rankings, revealing surprising shifts in the tech hierarchy while discussing everything from NSF funding cuts to Nvidia's China strategy.

Key Takeaways

- OpenAI maintains its S-tier dominance despite growing competition from Anthropic's Claude 4 and Google's Gemini 2.5

- Apple debuts in the newly-created L-tier, marking a shocking fall from grace in the AI race

- Meta's massive GPU spending on Recsys (recommendation systems) generates more revenue than their AI model development

- Chinese AI companies like DeepSeek and Alibaba are rapidly climbing the rankings, with DeepSeek now reaching A-tier status

- Nvidia's H20 chips for China represent a strategic long-term play despite lower profit margins than their flagship products

- The semiconductor industry faces a potential talent drain as NSF funding gets slashed and visa restrictions tighten

- European defense contractors like Rheinmetall and Japanese heavy industry firms present compelling investment opportunities

The Great AI Hierarchy Shakeup

What's fascinating about this quarterly update is how dramatically the landscape has shifted. Just three months ago, the rankings felt more stable. Now we're seeing genuine competition at the top tier for the first time in years.

OpenAI still holds the crown with their S-tier status, but here's the thing - they're not running away with it anymore. The release of O3 keeps them ahead, but Anthropic's Claude 4 is what Dylan calls "fucking fire," and Google's Gemini 2.5 has established itself as the price-performance leader. As one analyst noted, "Google is always on the curve essentially they set the curve of the best possible performance at any given price."

- OpenAI maintains S-tier with O3 leading capabilities

- Anthropic joins the A-tier party with Claude 4's impressive performance

- Google's Gemini 2.5 dominates the price-performance curve

- The competition at the top has never been more intense

The most shocking development? Apple's introduction to the newly-created L-tier. This represents a stunning fall for a company that once seemed unstoppable. They didn't even make the previous ranking, which somehow feels like a promotion given their current AI capabilities.

The Chinese Dragon Awakens

DeepSeek's rise to A-tier status represents something significant happening in Chinese AI development. Their R1 model demonstrates that despite compute constraints and export restrictions, Chinese companies are finding ways to compete at the highest levels.

The constraints are real though. As Dylan explains, "they're constrained on compute, because of the removal of diffusion, they're now renting GPUs in Thailand, in Malaysia, in Europe as well." This distributed approach to circumventing restrictions shows both resourcefulness and desperation.

- DeepSeek reaches A-tier with their R1 model despite hardware limitations

- Alibaba maintains C-tier with Qwen showing steady improvement

- Chinese companies are renting GPU capacity across Southeast Asia and Europe

- The talent pipeline from China continues to strengthen in AI research

Alibaba's Qwen model sits comfortably in C-tier, performing better than Meta's Llama but not reaching the heights of the top players. What's interesting is the rate of improvement - "it's improving at scary rate" according to the analysis.

Meta's Billion-Dollar Recommendation Reality Check

Here's where the conversation gets really interesting. Meta stays in D-tier for their AI models, but their actual GPU spending tells a different story. More than 50% of their massive GPU investments go toward Recsys - their recommendation system that determines what you see on Instagram and Facebook.

The economics are brutal and brilliant. Dylan breaks it down: "CPM is magically continues to go up, which it shouldn't if there's more impressions." This means Meta's AI investments are actually generating massive returns, just not in the way most people think about AI.

- Meta's recommendation systems generate more revenue than their AI model development

- Over 50% of Meta's GPU spending goes to Recsys algorithms

- Cost per mille (CPM) rates continue rising despite increased impressions

- The "slop" and "brain rot" content strategy is financially successful

The distinction between "slop" and "brain rot" becomes crucial here. As the team explains, "brain rot's more addictive. I think slop you can notice and move away from." Meta has mastered the art of creating addictive content that keeps users engaged, even if it doesn't advance the frontier of AI capabilities.

Nvidia's Strategic China Play

The discussion around Nvidia's H20 chips for China reveals a fascinating strategic calculation. Despite lower profit margins compared to their flagship H100 and H200 products, Nvidia continues investing heavily in the Chinese market.

The numbers are staggering. "Their operating profit from just Q1 was like $5 billion from China sales," and if they hadn't written down inventory, "they would have had like 13 to 15 billion of revenue and they would have had like seven eight of fucking operating profit." That's larger than Intel's profit for the entire last decade.

- H20 chips have lower margins than H100/H200 but still generate massive profits

- China sales contributed $5 billion in operating profit in Q1 alone

- Nvidia's China revenue could have reached $13-15 billion without inventory writedowns

- The strategy represents TAM preservation rather than margin maximization

The key insight is that Nvidia isn't being altruistic - they're being rational. When your total addressable market is global, losing a significant portion of it doesn't make sense, especially when you can still generate substantial profits at lower margins.

The Looming Talent Crisis

Perhaps the most alarming discussion centers on the potential collapse of America's AI talent pipeline. NSF funding for math and physics is being cut in half for 2025, and visa restrictions are making it harder for international students to stay and contribute.

Dylan's personal anecdote drives this home: "a girl I went on a date with her, she literally like had to cancel her PhD." When immigration restrictions start affecting dating prospects, you know the problem has reached critical mass.

- NSF funding for math and physics cut by 50% in 2025

- International PhD students increasingly unable to complete programs

- "50% of the AI researchers are in China" according to Jensen Huang

- The talent pipeline represents a "billion person maybe 500 million person TAM that is being cut in half"

The competitive implications are stark. As Dylan notes, "go to a STEM conference in the United States. It's a ton of old dudes who are in their 50s go to a STEM conference in Asia and it's like... they're all they look like there's 20 year olds as far as I can see."

The European Defense Renaissance

Shifting gears to investment opportunities, the conversation reveals some fascinating insights about European defense contractors. Rheinmetall emerges as a particularly compelling play, benefiting from increased defense spending that's unlikely to decrease even if the Ukraine conflict ends.

The thesis is straightforward: European defense spending remains low as a percentage of GDP, and geopolitical realities ensure it will increase regardless of specific conflicts. "Everyone's like, 'Oh, isn't Europe spending going to go down when the war ends?' And I'm like, 'It's low percent of GDP.'"

- Rheinmetall benefits from structural increase in European defense spending

- Defense spending remains low as percentage of GDP with room for growth

- Geopolitical tensions ensure sustained investment beyond current conflicts

- The investment opportunity exists independent of specific conflict outcomes

Japanese Industrial Conglomerates: Hidden Value

The deep dive into Japanese industrial companies reveals a fascinating investment thesis. Companies like Mitsubishi Heavy Industries (7011), Kawasaki Heavy Industries (7012), and IHI Corporation (7013) represent a unique opportunity.

These companies have historically operated as conglomerates with multiple unprofitable divisions alongside their profitable defense and heavy industry operations. The key insight is that many are now committing to divesting these money-losing operations.

- Japanese ticker system originally had logical sector organization

- Heavy industry companies (701x series) are restructuring operations

- Many profitable divisions subsidize unprofitable legacy businesses

- Management teams are committing to divest underperforming segments

The investment thesis is simple: "50% of the revenue makes negative profit. And they gave the commitment to quit." When you stop losing money on half your business, the profitable half becomes much more valuable.

The Chip Security Theater

The discussion of the proposed Chip Security Act reveals the kind of policy theater that frustrates industry experts. The bill proposes requiring chips to "phone home" to prevent unauthorized use, but as Dylan explains, this is trivially circumvented.

"Phoning home doesn't work. You can spoof that super easily... the first time you turn it on turns on in China and it the IP tunnels to wherever the fuck you want in Europe or LATAM or or Asia or Middle East." The real purpose isn't enforcement - it's providing ammunition for further restrictions.

- Current chip security proposals are easily circumvented

- "Phone home" requirements can be spoofed through IP tunneling

- The real goal is creating justification for additional restrictions

- Nvidia may use these measures as leverage to reduce other limitations

The smuggling reality is already well-established. Stories of individuals flying first-class between China and the US with servers in their luggage - buying for $240k and selling for $290k - illustrate how ineffective export controls really are.

The Mandate of Heaven Shifts

Looking at the complete rankings, the quarterly update reveals just how competitive the AI landscape has become:

S-tier: OpenAI maintains its position but faces unprecedented competition

A-tier: Anthropic, Google, and DeepSeek represent the new guard challenging for supremacy

B-tier: Only Grok occupies this tier, having moved up from C/D

C-tier: Alibaba holds steady with incremental improvements

D-tier: Meta continues focusing on profitable applications over frontier models

F-tier: Mistral, ByteDance, and Baidu struggle to maintain relevance

L-tier: Apple's shocking debut in the lowest tier

The artificial intelligence mandate of heaven is shifting faster than ever before. What seemed like OpenAI's unassailable lead just months ago now faces genuine competition from multiple directions. Anthropic's Claude 4 demonstrates that smaller, focused teams can compete with the giants. Google's Gemini 2.5 shows that established tech companies can still innovate at the frontier. And DeepSeek proves that even with significant constraints, determined competitors can reach the highest levels of performance.

The implications extend far beyond just model capabilities. The talent pipeline that feeds this competition is under threat from policy decisions that could fundamentally alter America's competitive position. Meanwhile, the actual profitable applications of AI - like Meta's recommendation systems - continue generating massive returns even as their frontier AI capabilities lag.

This quarterly update captures an industry in flux, where the old certainties no longer hold and new players are emerging from unexpected directions. The mandate of heaven in AI is no longer predetermined - it's up for grabs, and the competition has never been more intense.

What's particularly striking is how the conversation weaves together technical capabilities, geopolitical realities, and investment opportunities. The AI industry doesn't exist in isolation - it's shaped by immigration policy, export controls, funding decisions, and broader economic trends. Understanding these connections is crucial for anyone trying to navigate this rapidly evolving landscape.

Looking Ahead: The Next Phase of AI Competition

The mandate of heaven is shifting faster than anyone anticipated, and we're entering a phase where single-company dominance may become impossible to maintain. The convergence at the top tier signals that we've reached a point where multiple players can deliver frontier-level capabilities, fundamentally changing the competitive dynamics. As funding constraints tighten and geopolitical tensions intensify, the companies that survive and thrive will be those that can efficiently translate AI capabilities into profitable applications while navigating an increasingly complex regulatory landscape.

What to expect in the coming quarters

- OpenAI's S-tier position becomes increasingly contested as O4 faces direct competition from Claude 5 and Gemini 3.0

- Chinese AI companies accelerate their climb up the rankings despite hardware constraints, with DeepSeek potentially reaching S-tier

- Meta's recommendation system profits will drive a rethinking of what "winning" in AI actually means - capability leadership vs. revenue generation

- The talent pipeline crisis will force a major policy reversal or see the US lose its research advantage to Asia permanently

- Nvidia's Middle East training partnerships will reshape global AI infrastructure, creating new geopolitical dependencies

- European and Japanese defense/industrial companies will emerge as unexpected AI beneficiaries through increased automation and military applications

- Apple will either make a dramatic AI comeback or solidify their position as the biggest AI failure among major tech companies

- Export control circumvention will become so widespread that current restrictions will be recognized as ineffective theater

- The distinction between "AI companies" and "companies using AI profitably" will become the new dividing line for investors

- Consolidation will accelerate as smaller players realize they can't compete with the compute requirements of frontier models

The next year will likely determine whether we're heading toward a multipolar AI world or if one player can reassert dominance through a significant breakthrough. Either way, the old certainties are gone, and the mandate of heaven is truly up for grabs.